Question:

Why do you think many large corporations chose to borrow money to buy back their stocks rather than invest it for productive purposes between 2012 and 2020? (pre-Covid-19)1 2 3

* (this is US-centric, but I’d be interested in a global perspective too)

Some Possibilities:

-

- Too much regulation to make investment profitable?

- Too high taxes?

- Too much political uncertainty? (2012-2020)

- Customers already have what they need? Customers don’t want to buy more?

- Customers too maxed out. Customers can’t afford to buy more?4

- Company has a mature market position- there is little room to grow. 5 Better to “mortgage their credit rating”67 and redirect the money to other companies with better opportunities?

- Outsourcing to foreign firms removes need to build own manufacturing capacity?89

- Executives don’t want to take a risk on innovation and growth when low-interest rates make significant debt-driven share price increase a low-risk choice?

- Low interest rates tell you why borrowing is attractive but not why innovation and growth are less attractive than stock buybacks.

Vote in a Twitter Poll

Twitter has a maximum of 4 options:

Why did corporations borrow money to buy back their stock rather than invest it for productive purposes?

(from 2012-2020) | https://t.co/qulfbX3Yne

Reply with ideas in the comments:

— Tim Langeman (@timlangeman) May 6, 2020

I’m interested in other possibilities too. You can reply to this on twitter /reddit.

Obviously, the low interest rates were key in enticing companies to borrow. The question is why they didn’t invest more for productive purposes rather than buying back their stock. I obviously haven’t investigated this fully, that’s part of the reason why I ask the question.

My hypothesis is that the biggest factor behind buybacks was that companies didn’t believe that consumers in the US could afford to increase their consumption level.

US Wages have been stagnant for decades and 40% of American’s can’t afford a $400 emergency, so who would want to invest heavily into selling to such a customer.

That doesn’t answer the question of global demand. Further work will have to be done to research consumption potential and indebtedness in other countries.

Read Background Info:

1) The Story of the Seven Dwarfs Mining Inc:

How the Coronavirus Masked the Corporate Debt Bubble

2) Was Pre-Coronavirus Stock Market a Bubble Inflated by “Financial Engineering”? (2014-2020)

Follow-up:

If corporations were unwilling to invest then, what make you think that they will be willing to invest post-Covid?

by Tim Langeman

Footnotes:

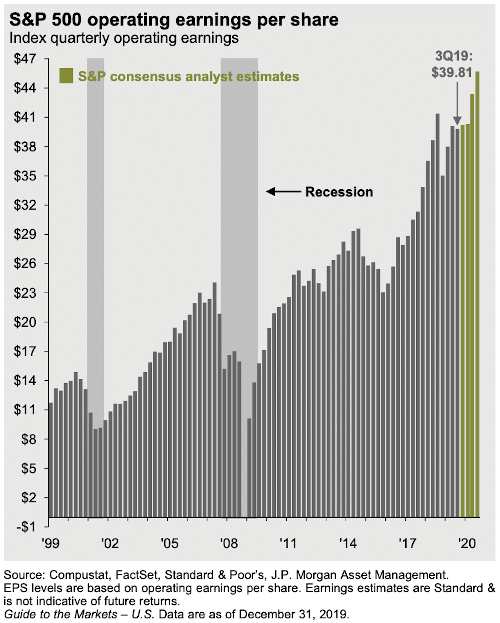

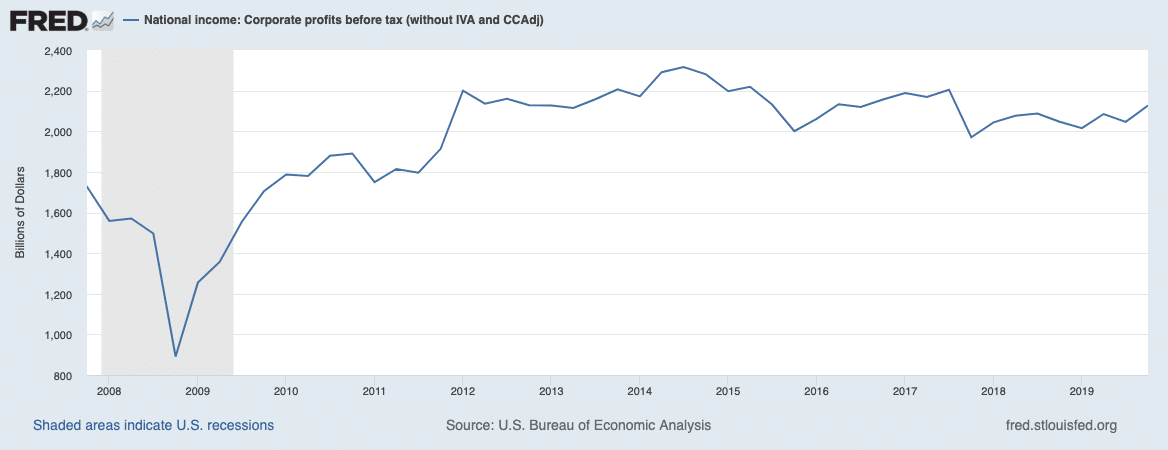

From 2014 through the start of 2018, corporate profits declined. The one-time spike in profits after 2018 was due to the corporate tax cut. Essentially, without the corporate tax cut, the corporate sector has seen virtually no profit growth since 2014.↩

“It’s a fair critique of corporate earnings to say that earnings “growth” in 2019 is a bit deceptive as the value is being financially engineered by corporate finance departments, not organic, core-business growth,” wrote Tom Essaye, president of the Sevens Report, in a Wednesday note to clients. “Companies aren’t making any more money than in 2018—they just have a smaller share count to spread the money over, so EPS are rising.”↩

Indeed, more than half of all buybacks are now funded by debt. And while there’s an argument that repurchases benefit share prices and investors, at least in the short run, it’s questionable whether highly indebted companies should be doing this. Sort of like mortgaging your house to the hilt, then using it to throw a lavish party.↩

Coca-cola has a harder time expanding market share than a startup company.↩

NPR’s “Planet Money” show had an excellent episode explaining Why so Few Companies have a Triple-A rating.↩

Many companies have had their credit rating downgraded to BBB – the lowest investment grade above “junk”. 50% of all Investment-grade debt is rated BBB.↩

Why build manufacturing capacity yourself when you can contract with Foxconn/etc and have them build manufacturing capacity?↩

This may relate to why they don’t invest, but it doesn’t answer why they choose to borrow to buy back their stock.↩