Was Pre-Coronavirus Stock Market a Bubble Inflated by “Financial Engineering”? (2014-2020)

1901 Cartoon: “Wall Street bubbles – Always the same“

American financier J. P. Morgan is depicted as a bull, blowing soap bubbles for eager investors

What Will the “Corona Virus Correction” Reveal?

It’s only when the tide goes out that you learn who’s been swimming naked.

Hypothesis:

What if Corporate Profit Growth from 2014 to 2020 was “anemic“, rather than strong? What if many companies who had very little profit growth obscured this fact by borrowing in the bond market and using the proceeds to buy back their own stock. Their stock prices went up, not because they had greater earnings, but because they had reduced the total number of shares. In one dimension — earnings per share — these companies looked more attractive, but the borrowing corporations used to achieve this metric masked profit growth weakness and caused the companies’ credit ratings to decline, with many corporations falling to near “junk” status (BBB). On the Eve of the Coronavirus Correction, corporate debt was $10 Trillion, leaving many corporations vulnerable to an unexpected stress, and ensuring that once a “match was struck”, the dry “tinder” would burn quickly.

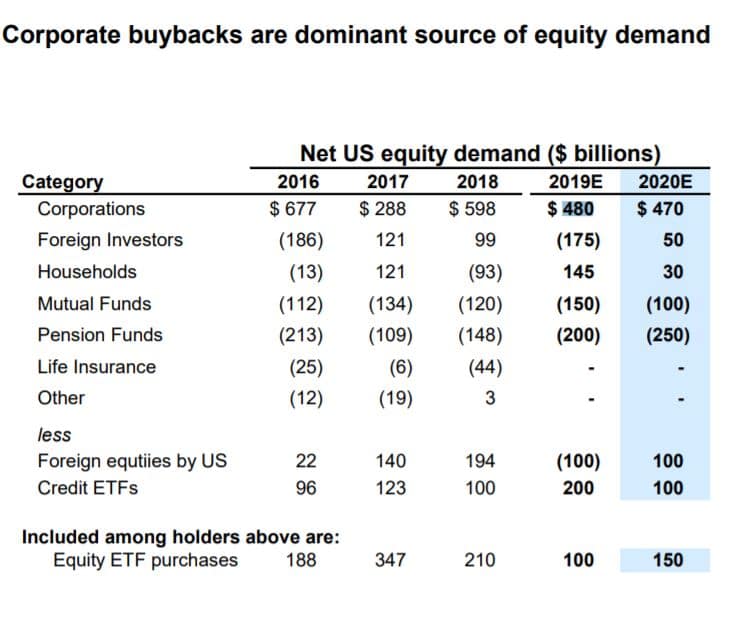

Now that the recession has begin, governments will be faced with reduced tax revenue and, as a result, will reduce their pensions’ purchases of bonds. Corporations have used money borrowed from these pension funds to buy back their own stock. Now that the pension systems have (indirectly) stopped lending them this money, corporations will have to reduce the amount of their stock buybacks. As stock buybacks decline, the ratio of sellers to buyers will rise and the price of these stocks will come under pressure.

It is too early to say where the bottom is to this recession, but we have reason to believe the Millennials and Generation X do not have the resources to purchase the stock that Baby Boomers want to sell at prior market highs. With Corporate profit growth unmasked and the Baby Boomer’s transition into retirement, it seems unlikely that stocks will make a quick return to their prior levels unless governments engage in massive asset inflation.

Here are my top 9 questions: #

- Is it true that Corporate Profits have been “Anemic” since 2014 and this has been obscured by “Financial Engineering”? 3 4

-

- Eric Basmajian writes on Seeking Alpha (Feb 28, 2020):

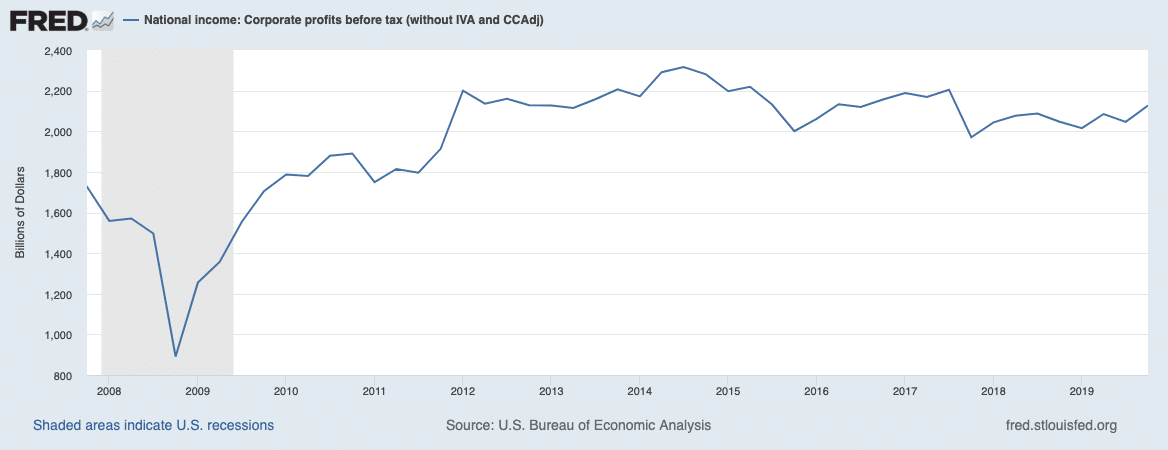

(click blue CiteIt.net arrows above and below quote to expand)Corporate America has been plagued by anemic economic growth in this economic cycle. Masked by the rising share price of roughly 500 companies, thousands of corporations that aren’t publicly traded have been forced to operate in a low-profit growth regime.

Financial engineering has allowed publicly-traded companies to report strong earnings growth. Total corporate profits reported in the GDP report is a far more accurate, albeit delayed, data source on the real (non-adjusted) profits generated by the corporate sector.

From 2014 through the start of 2018, corporate profits declined. The one-time spike in profits after 2018 was due to the corporate tax cut. Essentially, without the corporate tax cut, the corporate sector has seen virtually no profit growth since 2014.

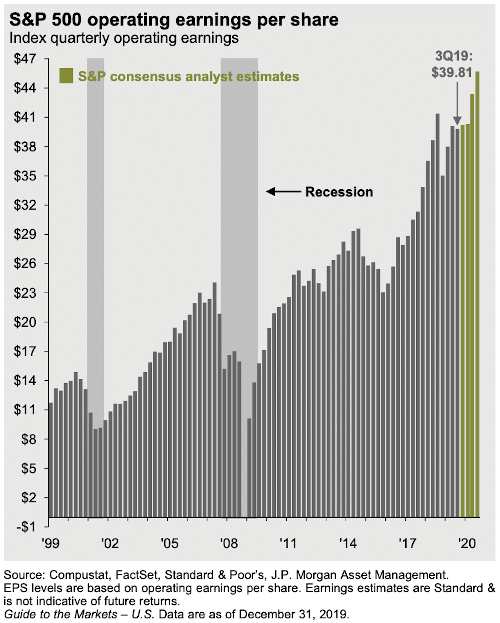

This assessment might seem “off” if you’re used to charts like this:

Chart 1: from JPMorgan (page 7):

- Eric Basmajian writes on Seeking Alpha (Feb 28, 2020):

But note that the S&P Earnings per share are heavily influenced by the share count reduction caused by buybacks.

- Here’s a different chart that features “total profits before taxes:“Chart 2: Corporate Profits Before Taxes: St Louis Federal Reserve

- Notice how flat profits have been since 2014 (actually it looks to me like they have been roughly flat since 2012).5

- Am I wrong to be concerned that companies appear to have engineered attractive EPS (Chart 2 – Earnings per Share from JPMorgan) by borrowing from the bond market (with funding from pension system) and weakening their credit ratings (many are rated just above “junk bond status”)?

-

Investors beware: Corporate profits are lower today than in 2014 : Marketwatch (Sept 26 2019)

-

Huge Disparity in Corporate Profits Hints at Something Amiss : Wall Street Journal (Dec 19, 2019)

-

- Is it true that Corporations have been the dominant buyer of their own stocks in 2018 and 2019?

- Chart 3: Source: Goldman Sachs via MarketWatch

“It’s a fair critique of corporate earnings to say that earnings “growth” in 2019 is a bit deceptive as the value is being financially engineered by corporate finance departments, not organic, core-business growth,” wrote Tom Essaye, president of the Sevens Report, in a Wednesday note to clients. “Companies aren’t making any more money than in 2018—they just have a smaller share count to spread the money over, so EPS are rising.”

(click blue arrows to expand quotations, created by CiteIt.net app)

- Is it true that over half of all stock buybacks have been made with borrowed money (Corporations borrowing to buyback their own stock)?

Indeed, more than half of all buybacks are now funded by debt. And while there’s an argument that repurchases benefit share prices and investors, at least in the short run, it’s questionable whether highly indebted companies should be doing this. Sort of like mortaging your house to the hilt, then using it to throw a lavish party.

- Is it true that there are only Two US Companies with a AAA credit rating and that many high profile brands have the the lowest possible rating credit rating above “Junk” status (BBB)?

- Corporations just above “Junk” status (BBB) (Source: Planet Money: Feb 5, 2020):

- McDonald’s 6, AT&T, Dell, General Electric, Ford, Kraft Heinz, Western Union, Fox, Verizon, Hasbro, Nordstrom, Marriott and Hyundai

(click blue arrows to expand quote: created by CiteIt.net app)

- McDonald’s 6, AT&T, Dell, General Electric, Ford, Kraft Heinz, Western Union, Fox, Verizon, Hasbro, Nordstrom, Marriott and Hyundai

- Corporations just above “Junk” status (BBB) (Source: Planet Money: Feb 5, 2020):

-

-

-

If the junk market were to be sufficiently disrupted, companies could be forced to default on their debts. That would likely force massive layoffs and sharp reductions in business investment, turning the financial market’s headache into a punishing economic ill, economists and money managers said.

“It’s going to amplify everything,” said Krista Schwarz, a finance professor at the University of Pennsylvania’s Wharton School. “It’s going to make everything happen faster, larger, worse. The recession would just be that much deeper.”

- To what extent are these companies’ debt a result of productive investment verses “financial engineering”?

- Has Russia and Saudi Arabia’s decision to engage in an oil price war already made a Corporate Debt Crisis more likely? (Washington Post March 10 2020)

-

-

- Is it true that Corporate Debt is at an all-time high ($10 Trillion), which, including off balance sheet debt, amounts to 74% of GDP?

-

- In July of 2019, Goldman Sachs Alum Raoul Pal explained how Corporate Debt could cause a financial crisis: (Starting 39 minutes into this video)

- Will a reduction of taxes during the recession cause government pension plans to reduce pension contributions, cutting off funding which corporations use to buy back their own stock, causing stocks to fall sharply?

- In July of 2019, Goldman Sachs Alum Raoul Pal explained how Corporate Debt could cause a financial crisis: (Starting 39 minutes into this video)

- 50% of all corporate investment grade debt was rated BBB in 2019 when this video was made (43:45)

- How high is the risk that 10-20% of BBB corporate debt gets downgraded in the next recession and become “fallen angels” , freezing the Junk bond market.

- Will a frozen Junk bond market prevent maturing bonds from being rolled over?

- Will Corporate Debt downgrades cause many pensions to go bankrupt?

- What effect will Corporate Debt have on the depth of the next recession and the speed of the recovery?

- Update: This is why the Fed started to buy BBB debt and fallen angels (recent “junk” bonds)

-

- If Corporations have had access to money (either cash or through low-interest borrowing or through tax-cuts), why didn’t they invest more of it for productive purposes, rather than buying back their own stock?7

- Have corporations viewed many of their investment opportunities as unattractive?

- Is this a problem on the demand side, rather than supply side?8

- Is it true that real median men’s wages have declined by 5% from 1979 to 2018? (Congressional Resource Service, R45090, Updated July 23, 2019) 9 10

- Is it true that ~40% of Americans surveyed by the Fed couldn’t come up with $400 in an emergency?

- Is it true that Millennials make 20% less than their parents did at the same age (with much higher student debt)?

- The answer to these last 3 questions determines the purchasing power of a significant portion of the population. The answer to this last question influences the ability of the Millennial and Gen X generations to buy out the baby boomers’ stock market holdings as the boomers sell stocks to finance their retirement.

Update:

- Feb 20, 2020: If this Economy is So GREAT, Why do I See Warnings .. : This is the first revison of this article, which I posted the day after the market peak.

- March 28, 2020: The coronavirus crisis is exposing how the economy was not strong as it seemed. (Washington Post)

Expanding Citations by CiteIt.net.

(click expanding blue arrows created with CiteIt.net app)

Footnotes

New York Times columnist James B. Stewart cited Buffett’s quote from a 1992 letter to shareholders. Stewart describes leveraged loans as a potential problem areas to watch: (March 10, 2020)

↩Leveraged loans, which are private loans to already heavily indebted borrowers, could now emerge as the mortgage-backed securities and collateralized debt obligations of the financial crisis.

Warren Buffet repeated this “swimming naked” quote in his Feb 2008 letter to shareholders. ↩

I recognize there are other factors. Performance has been obscured largely by a combination of:

- Financial Engineering,

- Corporate Tax Cuts, and

- Loose Federal Reserve Monetary Policy

It is also possible that tax avoidance could result in under-reporting of profits. (Source: Wall Street Journal: Dec 19 2019)↩

Note: this is not to say that there are not companies that have shown growth, but that the overall trend is towards stagnation (or a “plateau” in profits), while the S&P 500 rose from 1259 on Jan 1 2012 to 3230 on Jan 1 2020, an increase of 156%!↩

Some of McDonald’s motivation to pursue stock buyback may have been to “mollify activist hedge funds”. “More pertinently, a huge program like McDonald’s buyback of 2014-2016 is designed to encumber an organization’s balance sheet, adding so much debt that potential activists can’t leverage the company further to fund their own turnaround plans.” (Source: Motley Fool : May 10, 2018)

How commonly is debt taken on defensively to prevent shareholder activists from taking over the company?↩Yes, I understand the theory is that it is better for mature businesses to return capital to shareholders so that shareholders can direct it to companies that can make better use of capital, but this does not apply to buybacks made with borrowed money. If this is true for a broad range of companies, what does that say about how companies’ view of their opportunities?↩

Do Americans have too much debt and not enough income to warrant investment in the US? How much of that lack of income is due to globalization or other factors that can not be fixed by tax cuts or other supply-side incentives? ↩

Race, education, and gender are factors in employment wages. I chose median white male wages because recipients had historically received compensation sufficient to reach the “American Dream” . Compensation for women and minorities has improved, but these improvements seem unlikely to reach parity with the compensation white men received in the 1950s-1970s any time soon. ↩

I also realize that benefits have risen (particularly health insurance). So if you are an employer, I can see your point that total compensation is rising, even if wages aren’t. Nevertheless, median wages are stagnant or declining, which may explain why more households feel like they need two incomes, working a higher number of hours. ↩