If this Economy is So GREAT, Why do I See Warnings ..

1901 Cartoon: “Wall Street bubbles – Always the same“

American financier J. P. Morgan is depicted as a bull, blowing soap bubbles for eager investors

Note to Bethany Mclean’s Readers: There is a newer version of this piece.

Summary:

The corona virus may turn out to be the “straw” that broke the camel’s back. Whether or not this “straw” turns out to be large, it is important to focus on the rotten fundamentals it exposed.

When we look back on this era’s economy, we will remember a time of “Anemic Growth” when stock prices were propped up by Financial Engineering — a BuyBack Bubble that was funded by Corporate Tax Cuts and Debt that masked their true performance.

Eric Basmajian writes on Seeking Alpha:

From 2014 through the start of 2018, corporate profits declined. The one-time spike in profits after 2018 was due to the corporate tax cut. Essentially, without the corporate tax cut, the corporate sector has seen virtually no profit growth since 2014.

Financial engineering has allowed publicly-traded companies to report strong earnings growth.

Corporations were able to pump up their stock price by borrowing money in the bond market and using it to purchase their own stock. It used to be that there were dozens of AAA-rated companies; today there are only two. Corporate debt now stands at $10 Trillion, half of which is rated BBB, just above “junk” status. This corporate debt will make the recovery much more difficult.

Inspiration:

I was inspired to write this post by a 9 minutes story on NPR’s Planet Money about Corporate Debt:

What are the possible Consequences?

In July of 2019, Goldman Sachs Alum Raoul Pal explained how the crisis could occur: (Starting 39 minutes into this video)

Pre-Corona Virus Writing:

(This next part of this document was written on Feb 20, before news of the corna virus outbreak spread. At that time I had already concluded that the economy’s fundamentals were rotten)

Conventional Wisdom vs Fundamentals

Conventional Wisdom says that we’re living in a GREAT Economy.

I recognize that the Stock Market went up ~30% last year and the labor market is tightening.

.. but I question the fundamentals.

The Stock Market is not the Economy.

Are stock prices going up because of economic strength or because of weakness in other areas?

- weakness in the bond market due to the low Fed Funds rate and

- weakness in other global economies, whose investors have sent money to the US because their own economies are weak

- weakness in baby boomer retirement portfolios, where boomers are trying to “catch up” from prior low savings rates by taking outsized risk in stocks.

- fear that the federal reserve is going to have to monetize the debt and

- expectations that a “Powell Put” and quantitative easing will keep the party going at least through the election cycle.

If the economy is so great, Why do I see the following trends ..

Corporations

- Why is there $10 Trillion of US Corporate debt, half of it rated just above junk bond status? There are now only two AAA Companies — Microsoft and Johnson & Johnson. Many mainstream companies like McDonald’s, AT&T, Heinz, Dell, Ford, Kraft Heinz, Western Union, Fox, and Verizon are rated just above “Junk Bond” status.

- In the event of a downturn, many companies will have a rough time recovering (which likely will lead to more layoffs and an inability to borrow and invest).

- Part of the reason for this debt downgrade is that there were perverse incentives for companies to borrow money to buy back their stocks.

- Corporations bought their own stock with borrowed money, 1 combined with money from the corporate tax cuts which has helped inflate the stock market.

- David Rosenberg says that stock buybacks have broken the correlation between the stock market and the economy and that stocks will continue to rise regardless of fundamentals until corporations stop buying back shares.2

- This is because CEOs’ bonuses depend on meeting a target stock price.

- It is easier to generate artificial results by borrowing money to buy back shares than it is to increase share price by creating genuine value.

- This is because CEOs’ bonuses depend on meeting a target stock price.

Stock Market

- Investors have been pushed out of safer assets like highly-rated bonds and into stocks because interest rates are so low and Bonds and Certificates of Deposit return less than inflation.

- My 24-month FDIC-insured Fulton Bank CD was set to roll over for at 0.4% APR. Inflation is over 1% higher than what a two-year CD pays.

- Every day I have my money in the bank it is losing purchasing power relative to inflation.

- Inflation makes it difficult to get a return unless you go into riskier assets like stocks.

- Another factor influencing stocks is that baby boomers who haven’t saved enough for retirement are taking extra risk in stocks to try to catch up for their prior low savings rate.

The Public/Labor:

- Why are men’s wages so low and unlikely to catch up to productivity gains any time soon?

- From 1979 to 2008, the median male wage has gone down 5% (adjusted for inflation):

- Media wages for women have risen but from a much smaller base

- Households have only been able to increase their material standard of living by working more paid hours and taking on more debt. We’ve seen a little bit of wage movement lately, but we aren’t anywhere near returning to the prior capital/labor ratios.

- Why is the split between labor and capital so much lower than it was in the 50s and 60s?

- 65/35 vs 60/40

- If ~40% of Americans can’t come up with $400 in an emergency (according to a Federal Reserve Survey), we might question whether the economy is all that great and the next recession is going to be really tough.

Government

- Why does the Federal Government have a $Trillion Dollar Deficit, with future deficits increasing each year as far as the eye can see? In a March 31, 2016 Washington Post interview, the president said he would eliminate yearly deficits and pay off the debt in 8 years.

- Paying down the debt is beyond reach right now! What would happen to the economy if the government wasn’t able to run such large deficits?

- How would the economy be affected if the Federal Budget had to be cut by $1 Trillion?

- How large will the deficit be if we aren’t at the top of the economic cycle — if we have a recession?

- Why is the Fed Cutting interest rates, with another cut expected later this year? The “boom” may continue for a while, but the fundamentals are not healthy.

- Why has the Federal Reserve resumed Quantitative Easing (sometimes imprecisely called “printing money“)?

- In 2018, the Fed tried to increase interest rates and reduce the Fed balance sheet, but the President protested and Powell relented.

- So now the Fed is back to quantitative easing. (just don’t call it that) and now the President and market are (temporarily) happy.

- But if the economy is truly strong, you don’t need to cut interest rates or print money do you?

-

Moody’s Credit Ratings Agency (logo) Why, in a Real Vision Interview, did former European Central Bank Insider Etienne de Marsac talk about the US as a “hot emerging market” and talk about a future US Government Credit Rating Downgrade when describing a December 2019 Moody’s Credit Rating report.

2008 Crisis Response:

In 2008 we had a private debt crisis in the mortgage market (in part) because of the perverse incentives caused by the conflict of interest posed bt the rating agencies getting paid by the sellers they were grading. Ratings Agencies had previously been paid by the buyers of bonds.

In the runup to 2008, mortgage originators like Countrywide sold mortgages to unqualified borrowers because mortgage originators like Countrywide knew that the ratings agencies would “bless” their mortgages with a AAA rating. Had the ratings agencies been instead paid to rate the mortgages by the buyer, the theory goes, rating agencies wouldn’t have been so lax.3 When the bubble was exposed, the Fed and Congress responded by assuming ownership the private debt (directly and indirectly).

Here is the increase in debt from 2008-2020

- Federal Gov: $10 -> $22 Trillion

- Federal Reserve ~ $1 -> $4 Trillion

We didn’t solve the debt problem, we just nationalized it!

Now Corporations have taken advantage of the low interest rates to grow corporate debt to $10 Trillion!

When the Next Recession hits:

This next recession is going to be bad because it will coincide with the demographic transition of a large cohort of baby boomers into retirement.

- When Baby Boomers stop working (and investing) and start to sell to fund living expenses, there will be more people selling than buying, putting downward pressure on stocks.

- This demographic pressure, coinciding with a recession, will make the recession more difficult to escape. Financial Advisors sometimes advise investors to have a bond asset allocation of 110 minus your age (with caveats). Alarmingly, the typical boomer has the inverse of this — an inappropriately risky 70% stock allocation. When the next recession hits, boomers will suffer major losses, without the ability to use wages to gradually buy back into stocks at the lower prices. This will be a scarring experience for a generation that has historically take higher risks. Raoul Pal predicts that burned Boomers will suddenly become the most risk-averse generation in history.

- Foreigners have been piling into US Markets, which inflates stock prices because the US is currently one of the few growing markets worldwide.

- The Younger (Millenials/GenX) aren’t in a position to buy sufficient amounts of stocks to compensate for the baby boomer’s retirement:

- Millennials have more student debt, and they are needing to borrow to get into the housing market.

- Their incomes are 20% lower than their parents at the same age.

- They can’t afford to buy stocks at current prices. That is to say, there is a supply vs demand imbalance.

- Federal Reserve:

- The low ~1.5% Fed Funds rate provides the Fed with less headroom to make cuts to support the economy in a downturn.

- Ben Bernake and others have talked favorably about “Modern Monetary Theory” as a way to implement a “Helicopter Money Drop” to monetize the debt.

- The Fed has talked about the need to have Fiscal Policy (spending by Congress) to respond to the next crisis.

- The Fed has talked about setting aside money for Congress to spend so that Congress does fiscal stimulus rather than austerity.

Summary

So what am I missing? I’d love to be wrong about this.

My approach here is to throw out the perspectives I’ve heard and look for feedback.

You can send me an email or comment below:

Update 1:

My friend Bryan pointed me towards the St. Louis Fed Financial Stress Index, which is currently below zero, but note that the index went from zero to bailouts in only 9 months. I’m not suggesting we’re going to need bailouts in 9 months, but it’s quite likely that the Fed will have to increase quantitative easing.

My main point though is that the next recessing will be prolonged because the fundamentals are weak. Interest rates are already low and corporations, governments, and consumers all have a lot of debt going into the next cycle. Furthermore, demographics are working against growth.

Update 2: Raul Pal’s Call on the Next Recession: #

- It looks like the current repo market action is not QE, but when QE happens, it is expected to be rolled out in a complicated way that is very technical and boring, so as to obfuscate what is really happening.

- The Fed isn’t the only institution that can stimulate the market. There is a report that Treasury Secretary Mnuchin has Treasury money to lend to hedge funds using the repo market. It is suspected he will use this money to stimulate the market in an election year and “there is nothing the Fed can do about it without blowing up the markets”. Whether he uses this ability is an open question.

- Hedge funds are leveraged 12-15 times 4 and there is little growth outside the FANG stocks and corporations buying back their own stocks with borrowed money.

- Raoul Pal (formerly of Goldman Sachs) predicted in July of 2019 that Europe will need to nationalize the banks, which is why Christine Lagarde (formerly of IMF) is now the head of the ECB. Lagarde was not hired for her economic skills, but for her political negotiating skills to deal with this upcoming bailout.

Corporate Debt: Next Recession’s “Poster-Child” #

In the US, Corporate Debt will become the poster-child of the next recession.

Pal explains how the crisis could occur: (Starting 39 minutes into this video)

Video Source: Real Vision: Is a Recession Coming: July 2019

Summary of Raoul Pal’s Scenario:

- 50% of the Corporate debt is BBB (the lowest non-“Junk” status).

- Corporate cash flow is cyclical and falls in a recession.

- As as cash flows fall in a recession, 10-20% of the $5 Trillion BBB Corporate debt will be downgraded.

- Pension funds are not allowed to hold bonds rated less than BBB.

- Pensions will be forced to sell downgraded BBB debt and take losses.

- This will essentially bankrupt pensions and they will switch to Treasuries at 1% yield or less.

- “Junk Bond” buyers are a different group of buyers than “Investment Grade”, with less capacity.

- The Junk Bond market is only $1 Trillion. (Remember: BBB is 50% of $10 Trillion).

- If 10-20% of BBB are downgraded to “junk”, the Junk Bond market will be overwhelmed by “Fallen Angels” 5

- As tax receipts fall, a stressed Pension System will buy less bonds.

- Pal Predicts: The Junk Bond market will freeze when BBBs are downgraded.

- There is a “Wall” of Maturing Debt that will be hard to roll over.

- Since Pension funding will have dried up, a stressed bond market will no longer be the source of funding for stock buybacks.

- Stock Prices are currently driven by stock buybacks funded with money borrowed from the bond market.

- With lower tax receipts to fund Pensions, we’re losing both the funding for bonds and equities.

- The Baby Boomers will Sell out Stocks because they fear they won’t be able to buy back in during retirement.

- Millennials and Gen-X do NOT have the capacity to meet all the Boomer selling.

- Equities will fall in a big way.

- Banks have a difficult time operating under low interest rates.

- European Banks are facing a shortage of dollars, combined with low interest rates.

- Europe will be forced to intervene in and recapitalize their banking system.

- The US Government will have to bail out the pension system.

Update 3: Virtually No Growth (2/27/2020) #

- Coronavirus Is A Match That Lit The Overvaluation Tinder

- Corporate Credit, Employment And Recessions – Putting It All Together: (Eric Basmajian, seekingalpha)

Corporate America has been plagued by anemic economic growth in this economic cycle. Masked by the rising share price of roughly 500 companies, thousands of corporations that aren’t publicly traded have been forced to operate in a low-profit growth regime.

Financial engineering has allowed publicly-traded companies to report strong earnings growth. Total corporate profits reported in the GDP report is a far more accurate, albeit delayed, data source on the real (non-adjusted) profits generated by the corporate sector.

From 2014 through the start of 2018, corporate profits declined. The one-time spike in profits after 2018 was due to the corporate tax cut. Essentially, without the corporate tax cut, the corporate sector has seen virtually no profit growth since 2014.

As a result of lower profits and more debt, the leverage ratio in corporate America has surged to recessionary levels.

Importantly, the leverage ratio usually increases during a recession as profits (the denominator) fall. Morgan Stanley’s research from 2018 calls out that leverage is at an all-time high in a “healthy economy,” which highlights just how leveraged and sensitive to changes in interest rates the corporate sector has become.

Employment growth over the next six months remains critical. If corporations continue to post weaker rates of employment growth or accelerate layoffs as a result of the Coronavirus outbreak, a recession is still firmly in play.

Currently, a recession is not imminent based on the data above. Still, the situation can evolve quickly, and the economy is far from immune to a shock in its current state.

If conditions worsen or simply do not improve for several weeks, a recession may be difficult to avoid, mainly due to the initial conditions before the shock beg

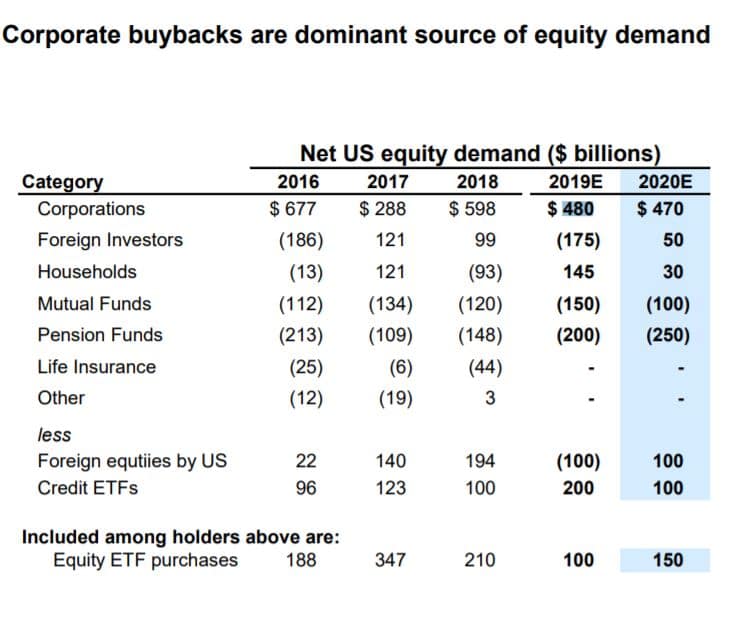

Update 4: What Would Happen if Corporations Stopped Buying Stock? (2/29/2020)

Corporations are on pace to provide $480 billion in bids for S&P 500 SPX, -0.82% stocks this year, according to an analysis by Goldman Sachs, providing more demand than any other source in 2019, including households, mutual funds or exchange-traded-funds.

“It’s a fair critique of corporate earnings to say that earnings “growth” in 2019 is a bit deceptive as the value is being financially engineered by corporate finance departments, not organic, core-business growth,” wrote Tom Essaye, president of the Sevens Report, in a Wednesday note to clients. “Companies aren’t making any more money than in 2018—they just have a smaller share count to spread the money over, so EPS are rising.”

Source: MarketWatch (11/9/2019)

More than Half of All Stock Buybacks are Now Financed by Debt. Here’s Why That’s a Problem

The era of cheap borrowing is fostering corporate America’s favorite investor-pleasing activity: Share buybacks.

Indeed, more than half of all buybacks are now funded by debt. And while there’s an argument that repurchases benefit share prices and investors, at least in the short run, it’s questionable whether highly indebted companies should be doing this. Sort of like mortaging your house to the hilt, then using it to throw a lavish party.

Borrowing oodles of money to buy back shares at the end of an economic cycle, when share prices are near record highs, may seem especially dubious for highly indebted companies like AT&T and American Airlines. Buybacks per se are not inherently wrong-headed, wrote RIA Advisors Chief Investment Strategist Lance Roberts on the Seeking Alpha site, but “when they are coupled with accounting gimmicks and massive levels of debt to fund them … they become problematic.”

Source: Fortune (8/20/2019)

Update 5: (March 10, 2020)

Fears of corporate debt bomb grow as coronavirus outbreak worsens

The mammoth debt bulge includes a significant increase in borrowing by firms with the lowest-quality investment grade — those rated just one level above “junk.” More than $1 trillion in “leveraged loans,” a type of risky bank lending to debt-laden companies, is a second potential flash point.

Update 6: (March 18, 2020)

- Eric Basmajian : Seeking Alpha (Feb 28, 2020)

-

Investors beware: Corporate profits are lower today than in 2014 : Marketwatch (Sept 26 2019)

-

Huge Disparity in Corporate Profits Hints at Something Amiss : Wall Street Journal (Dec 19, 2019)

whose interest rates were low because of the economy’s weakness and Fed Chairman Powell’s response to the President’s very public twitter complaints about the Fed’s prior 2018 rate increases↩

Update Feb 28: Or corona virus fears materialize↩

Hedge Fund investor James Simmons commented that the ratings agencies changed their business model because their reports were being shared amoungst investors (similar to the problems the recording industry had with Napster)↩

12-15 dollars borrowed money to every 1 dollar of their own↩

A “fallen angel” is a bond that was given an investment-grade rating but has since been reduced to junk bond status due to the weakening financial condition of the issuer. It is also a stock that has fallen substantially from its all-time highs. Source: Investopedia ↩