Bitcoin Info > 16 Things Bitcoin is good for

- Bitcoin solved the problem of how to register and transfer private property in the digital world without having to trust government or banking officials. (more)

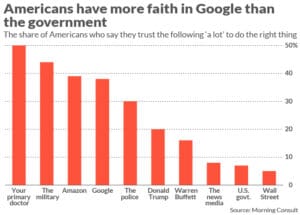

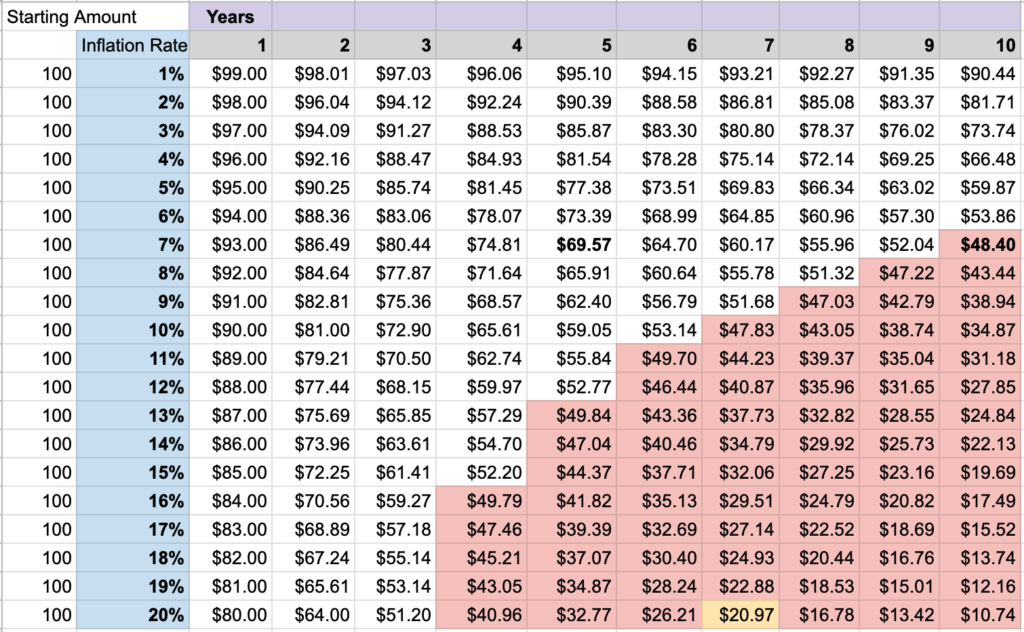

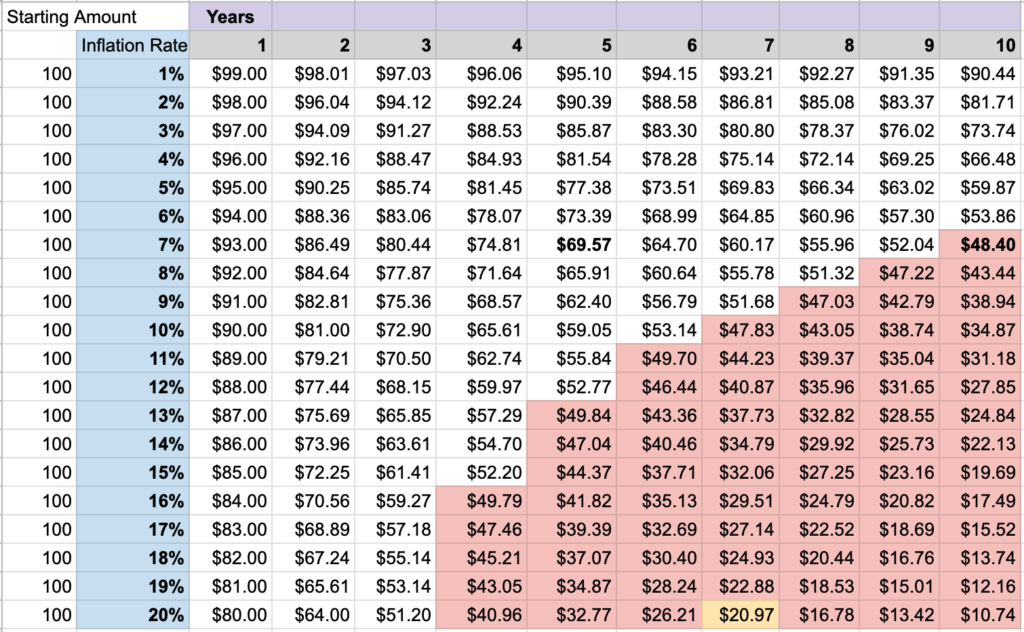

- Bitcoin offers a credible way to have a non-inflationary currency at a time when there is low confidence in government’s ability to maintain the value of the currencies.

- Bitcoin offers a private alternative (or hedge) to a future government-sponsored digital dollar which people fear will include:

- surveillance

- cancellation

- social credit scores

- inflation

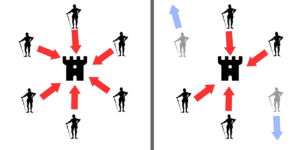

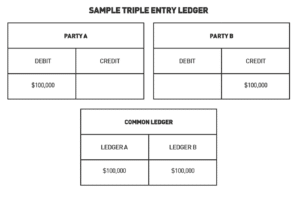

- Bitcoin’s technology is superior to the Federal Reserve’s Fed Wire, which allows people to wire funds from one bank to another. (Federal Reserve vs Bitcoin diagram)

- Fed Wire takes several hours – days to transfer between Fed connected banks.

- Bitcoin takes 10 minutes – an hour and can transfer to anyone in the world with an internet connection.

- Bitcoin’s Lightcoin layer enables instant transactions that settle later in a batch (see below)

- A sub-project of Bitcoin — the Lightning Network — offers the possibility to displace Western Union (video) and has forced Mastercard and VISA to develop Bitcoin strategies. It is possible to buy a coffee at a Starbucks in El Salvador and only pay about half a cent in fees, while VISA charges roughly 2.3% + 23 cents.

- To be sure, Bitcoin adoption for payments will be inhibited by its volatility and its tax treatment in the US,1 but the Lightning network is instant, cheaper, and works anywhere in the world with an internet connection.

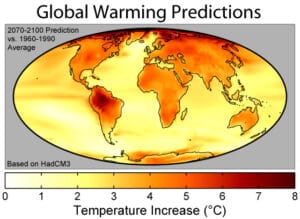

- Bitcoin is Anti-Consumerism: The current monetary system depends upon inflation and “growth” in GDP. It would collapse without growth, which is why it is incompatible with anti-climate-change efforts. A system that rewards long-term thinking over short-term gratification is likely to do more for the environment than the minor green washing tweaks that our economy produces. The inflationary dollar encourages people to consume now because the dollar will be of less value in the future. A currency with a non-inflationary monetary policy encourages people to save and invest because they know the money they save will be worth more in the future.

- Some economists want a monetary policy that encourages consumption, but in the long term we need to shift consumption habits to reduce our environmental impact. A monetary system where people delay gratification to make Marie Kondo-inspired purchases will save more energy and resources than Bitcoin mining uses.

- Note: The 10x gains the author is speaking of will decline as Bitcoin becomes more widespread, but even if Bitcoin becomes ubiquitous there will still be stronger rewards for investment over consumption.

- “Openness“- first open monetary network: the key feature that made the open internet better than the privately-owned Compuserve and AOL. These privately-owned networks thought that there was value in being proprietary, but Compuserve users wanted to connect with everyone, not just those in their own walled garden. Bitcoin is the first open monetary network that anyone can join at no cost. Imagine if Yahoo and Google users couldn’t exchange email and had to create separate accounts on each service. Paypal users can’t send money to Venmo users, which is why we need an open standard.

- Diversification: Stocks and Real Estate go up and down together. The fact that Bitcoin is less correlated with Stocks and Bonds makes it a useful addition to a portfolio in small quantities

- This Economist article makes the case for diversification but notes the risk that Bitcoin goes to zero. 2

- Bitcoin is the first truly Fair Monetary system, an alternative to the biased Cantillionaire system that privileges elites who are closest to the money supply with special benefits. (audio version) People on Wall Street currently benefit from getting access to the creation of new money before prices have adjusted to the new money supply. Big companies like Blackrock are buying up houses with new money before the housing market has adjusted to the new currency levels. After Blackrock buys houses and the money circulates, the price of housing increases for you and me.

- Bitcoin’s Lightning layer can be used to make micropayments, which could provide publishers with a way to get funding beyond the advertising-supported click-bait business model many now use. Jack Dorsey says Bitcoin is going to be a big part of Twitter and Twitter has just rolled out Bitcoin tipping. The media is currently in a bad way. This could get at the root of the funding problem.

- Blockchain, the technology behind Bitcoin powers Vanguard’s Index fund price updates.

- Bitcoin has led to the creation of a new digital finance industry that has the potential to power systems that exchange ownership of stocks, mutual funds, and real-estate. (more real estate)

- Bitcoin and crypto make it cheap and easy to provide banking services to the unbanked.

- The more people learn about Bitcoin, the more they learn about the American Petrodollar and its disastrous consequences for wars, women’s rights, human rights, the environment, and harm of America’s export industries like manufacturing.

- Transitioning from a dollar backed by oil to one backed by electricity has the potential to finance investments in renewables.

- Hard money like Bitcoin penalizes unpopular wars. Imagine what would happen if governments would have to finance wars by fundraising from the public (i.e. through war bonds, like during World War II) rather than just printing $8 Trillion dollars.

- If financing wars wasn’t so easy, would the recent Iraq and Afghanistan wars have lasted 7 and 20-years? Leaders would have to justify the war’s mission and costs, rather than saying that the war would pay for itself and that Americans should just go shopping.

10 Years of Inflation:

Common Criticisms of Bitcoin:

- Bitcoin has no intrisic value. (2) It’s just numbers on a computer, created from nothing.

- Bitcoin solves the problem of transferring digital property without having a trusted central authority.

- Bitcoin offers a credible way to have a non-inflationary currency at a time when there is low confidence in government‘s ability to maintain the value of the currencies.

- The technology behind bitcoin forms the basis of a superior payment network that is cheaper and faster to settle.

- Bitcoin is more portable. It is not tied to the legacy banking system or the proprietary systems like Venmo and Paypal that have been built on top of it. Bitcoin can quickly be transferred to anyone in the world with an internet system.

- Bitcoin makes micropayments possible using the Lightning network. This could have a big impact on media struggling with an advertising-based model.

- Bitcoin pre-empts government sponsored digital currency systems that people fear will be ripe for abuse.

- Bitcoin uses too much energy/causes global warming.

- Bitcoin is used by money launderers and other criminals.

- “Bitcoin Isn’t Scalable”. It can only do 7 transactions per second.

- Bitcoin takes 10 minutes for one transaction. No one will use it to buy a coffee.

- Nobody buys coffee with Fed Wire, but people in El Salvador do buy coffee using the Lightning network, which is build on top of Bitcoin.

- At this point it doesn’t make sense to use Bitcoin for payments in the US because Bitcoin’s price is still too volatile and you also have to calculate and pay capital gains tax on every payment. At this point it would be like buying pizza with early Amazon stock.

- Bitcoin is a ponzi scheme.

- Bitcoin is a bubble.

- Bitcoin is too volatile to be used as a currency.

- There are some 8000 cryptocurrencies. How do I know what to pick?

- Governments are going to ban on Bitcoin.

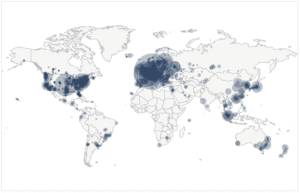

- Bitcoin Mining is Centralized (not actually a common criticism)

- People predicted high inflation in the past and it didn’t materialize.

- Paul Krugman: Gold isn’t useful and “Digital Gold” isn’t useful either.

- 2021 article: Technobabble, Libertarian Derp and Bitcoin:

- Cryptocurrencies are inspired by Libertarians (which is bad).

- The Crypto technology is hard to understand, therefore it should be dismissed.

- As a proponent of social welfare policies, I need governments to be competent and trustworthy. Therefore, trusting Governments with fiat currencies and inflation shouldn’t be such a problem; and

- The Global Reserve Currency isn’t such a big deal.

- 2021 article: Technobabble, Libertarian Derp and Bitcoin:

Good arguments to debate about Bitcoin

Things to Understand about Bitcoin:

- There will never be more than 21 million Bitcoins produced, unlike dollars whose printing is unlimited.

- What prevents the 21 million limit from being increased.

- Bitcoin is decentralized and not controlled by anyone.

- Bitcoin is more like the Federal Reserve than like VISA. (diagram) The banking system uses multiple layers.

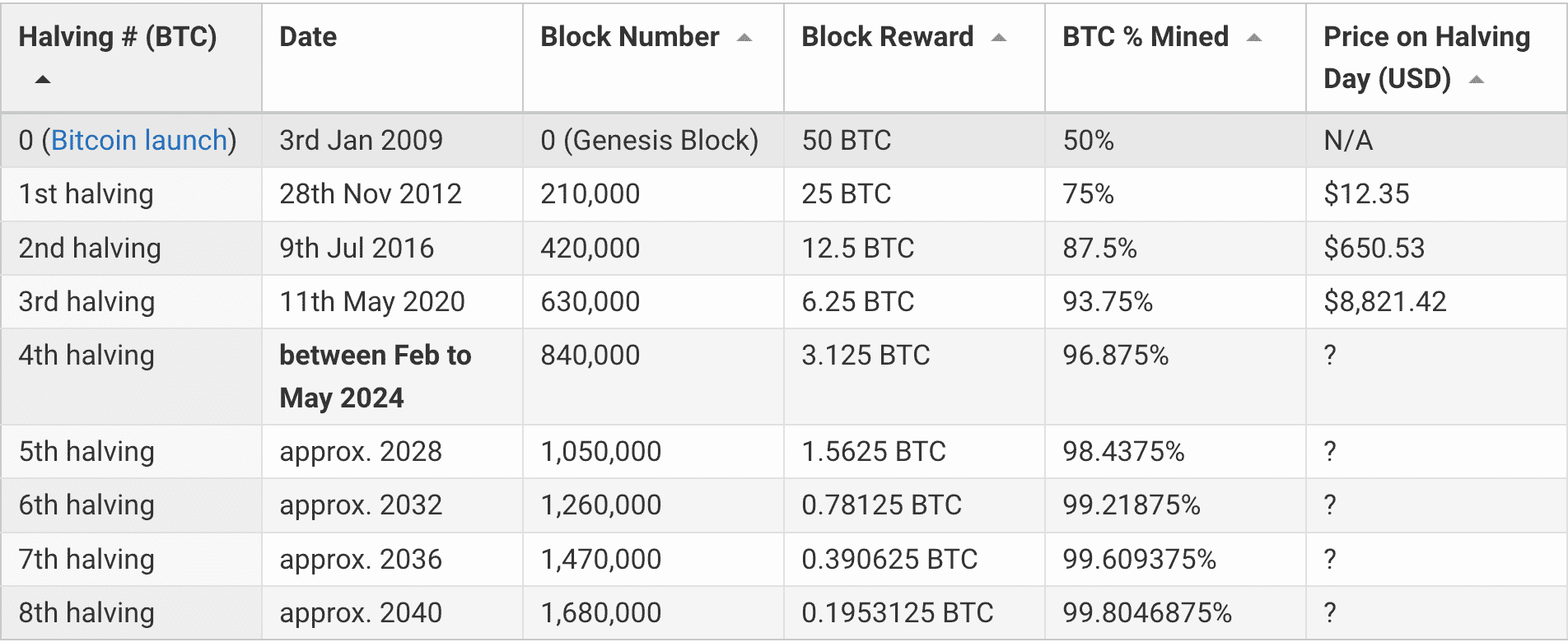

- The Halvening: Every ~4 years, the amount of fees that are paid to miners for validating transactions gets cut in half.

- This cuts the issuance of new Bitcoin in half, making Bitcoin more scarce

- From 2016 – 2020, the fees were 12.5 bitcoins per block

- From 2020 -2024, the fees are 6.25 bitcoins per block

- This increased scarcity leads indirectly, to higher prices

- This cuts the issuance of new Bitcoin in half, making Bitcoin more scarce

- How Bitcoin is like Telsa: Tesla was built with early adopters who saw past certain drawbacks. Once the innovation was adopted, prices dropped and drawbacks declined.

- Some alternatives to Bitcoin, called Alt-Coins serve serve different roles like stocks, mutual funds, applications, membership tokens, and insurance.

- In the future, people in Zimbabwe may get crop insurance even if their local governance and businesss climate does not support an insurance industry. The insurance could use two crypto tokens:

- At this point the base case future for Bitcoin is that it will function as a store of value that resists inflation (as opposed to a checking account). If inflation is moderate to high, some of the population may choose to keep some of their savings in Bitcoin.

Blockchain Explained: Wired Explainer

Buying Bitcoin?

Even if you are convinced that Bitcoin is valuable, none of these arguments suggest that the current price of Bitcoin makes it a good buy.

There are a significant number of people buying Bitcoin with leverage (borrowed money). Bitcoin’s volatility makes this an especially risky thing to do. Periodically, volatility in the Bitcoin market causes these people’s positions to get liquidated and prices to fall more than they otherwise would. The other potential downward pressure is that when people borrow and lose money betting on the stock market, they sometimes need to sell their Bitcoin to raise funds to cover their stock market losses. This means that losses in the stock market have contagions in the Bitcoin market.

If you do buy Bitcoin, you should be educated about FUD to avoid “panic selling” during times of volatilty. It should only be done for the long-term (at least 5-years) and only as a small portion or your portfolio that you can afford to loose (roughly 1-5% depending on your age and conviction). One way of building a position for Bitcoin is by dollar-cost-averaging – buying small, equal amounts on a schedule.

Read More:

- Tim’s Bitcoin Info page

- The Bullish Case for Bitcoin by Vijay Boyapati

- The Bitcoin Whitepaper by Satoshi Nakamoto

- The Byzantine Generals Problem which Bitcoin solved (wikipedia)

- The Humanitarian & Environmental Case for Bitcoin (audio) by Alex Gladstein)

- An Analysis of Bitcoin’s Use in Illicit Finance, by former Acting CIA Director Mike Morell

- Federal Reserve vs Bitcoin diagram, by Tim Langeman

- Bitcoin and Cryptocurrencies Explained, by Tim Langeman

- Misconceptions about Bitcoin, (audio version) by Lyn Alden

- Can Bitcoin Mining Save the Environment? with Troy Cross

- Investing in Bitcoin: 6 Pros and 6 Cons, by AARP

- Quantitative Easing, MMT & Deflation by Lyn Alden

- (audio part 1)

- (audio part 2)

- The Fraying of the US Global Currency Reserve System, (wonkish),

by Lyn Alden (audio part 1) (audio part 2) - Check your financial privilege : Bitcoin Magazine

- What is asset tokenization? (Not Bitcoin, but Crypto related)

- Governments will co-opt Bitcoin, neuter its independence, create Bitcoin derivatives, and turn society into a panopticon. by Ben Hunt

<< Bitcoin Info: Main

In the US, whenever you buy something, you have to figure out your capital gains or losses on each transaction and file this with your taxes. This makes it unlikely that Bitcoin will gain widespread use, even if volatility diminishes.↩

The video also contains misrepresentations, such as the number of transactions Bitcoin can perform for payments and the rate of criminal activity).↩