Bitcoin and Digital Currencies Explained

Bitcoin Info > Bitcoin and Digital Currencies Explained

How much is the Mona Lisa worth?

If you had the opportunity to purchase the Mona Lisa painting for $10,000, would you seize the opportunity? Granted, you would need to authenticate the painting and protect it from damage and theft, but purchasing such an iconic painting for such a “small” price could be regarded as a once-in-a-lifetime opportunity.

A quick google search shows that the painting’s resale value is likely much higher than your purchase price since the Mona Lisa’s 1962 sale price would amount to $860 million dollars when adjusted for inflation.

Scarcity in the Physical World

What about purchasing an iconic photo like Joe Rosenthal‘s Flag Raising on Iwo Jima?

In the physical world, photographs have negatives which can prove ownership, but in the digital world where everything can be duplicated there seems to be no way to prove who owns what.

Transferring Title Ownership

If I sell you my car, we’ll go to a local notary where a licensed official authenticates the title and transfers it to you. The title for an asset like a car or land is stored with the state government and the authenticity of the transfer is recorded by a trusted third-party – a notary.

Digital Money is transferred like a Car Title

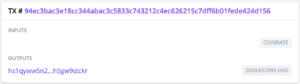

You may wonder what housing and auto titles have to do with money — in Bitcoin and cryptocurrencies the all the coins have the equivalent of a title and their ownership is tracked on global financial ledger, much like a car our house deed are registered with the state.

So imagine that the government used bitcoin to issue you a tax refund.

The Bitcoin ledger would record a transaction of the form:

| From | To | Amount |

|---|---|---|

|

(IRS) |

(You) |

0.0246912 BTC

($1234.56) |

Notice that the “From” and “To” fields record a long identifier, rather than your name, although it is possible to infer your identity with enough analysis.

Now back to digital art ..

Limited Edition Prints

Limited Edition Prints

If I were Joe Rosenthal, the photographer who took the photo of the Flag Raising on Iwo Jima, I could sell limited edition prints of my photo using the negative. If I made only 50 large prints and sold them for $1 million each, I could earn a total of $50 million dollars.

But if one of my customers buys a print and has it scanned and duplicated, they could create an unlimited number of unauthorized prints and sell them for whatever they choose. Perhaps there is a way to authenticate the prints, just like it is possible to detect forged 100 dollar bills, but authentication comes at a cost of time and money.

Digitally Certified Copies: NFTs: Non-fungible Tokens

Now imagine that every virtual currency or digital asset like a photo, video, or music were treated like we treat important physical assets like vehicles and land. Imagine that digital currency and assets were registered to an owner and that ownership were digitally signed with an encryption-like certification.

This recording of ownership in a ledger is exactly what happens with the “NFT” feature of “cryptocurrencies” like Etherium and Solana. Groundbreaking artists and musicians are currently some of the first people to experiment with releasing their works as NFTs: Non-fungible Tokens. 1 Creators can make a chosen number of copies of an image2 and sell them on the blockchain — the digital ledger that logs property ownership records.

With NFTs, there is no need to find an expert to verify that the purchase is authentic, even it it has been resold multiple times because the record on the internet blockchain tracks and verifies ownership. The other thing about digital property is that the creator can set out certain terms when they create it, such as the creator gets a 5% royalty whenever the digital asset is resold. This electronic contract executes whenever the item is sold and generates something that can not easily be replicated in the physical world — a continuing stream of income for the creator after they’ve sold the original.

NFTs function as a Digital Membership Coin

Raoul Pal predicts that NFTs will also be used by many companies as a way to offer special benefits to customers who are willing to purchase something akin to a digital membership coin that can be sold like a stock.

As an example, the Disney token may entitle the holder to a lower price on the Disney channel, specials at Disney world hotels, and special access to certain rides.

Crypto Winners and Losers: Arguments for and Against

Crypto Winners and Losers: Arguments for and Against

Some of this digital technology may make artists less reliant on the entertainment industry because it provides artists a way to sell directly to their customers. Or perhaps the major industries will quickly adapt and capture the new revenue streams. There are likely to be winners and losers with regard to this new technology. Keep this in mind whenever you hear arguments for and against the technology because all of the economic players are incentivized to make self-interested arguments for or against digital money and digital assets.

The Internet doesn’t Follow Physical Rules

In the 1990s there was an understanding that normal physical world rules do not apply on the internet where people’s identities are not known and digital information can be easily duplicated. When I was in university, it was popular to download music using programs like Napster and Bit-torrent.

Since then, people have been working to add some of the physical rules to the digital world.

Unlike the 1990s when “nobody knew you were a dog”, right now when you go to a website, the website can tell what country you are in. With Google maps, it can actually tell you exact location.

So it was only a matter of time until someone developed a way to re-establish property rights for digital assets.

Digital assets and digital currency are valuable, in part, because their creators managed to overcome the technical problems that prevented the property rules we are accustomed to in the physical world from being applied to the digital world. The other crucial reasons why digital currencies are seen as valuable is that the world is transitioning to digital currency and there is a suspicion that financial and political institutions will be unable to maintain the value of their currencies due to inflation.

Government Digital Currencies: Surveillance & “Cancellation”

In addition to concerns about monetary debasement, many people are also concerned that a digital currency could give the government extreme levels of power through surveillance and cancellation.

We can all imagine the potential for abuse that could come from the creation of a system where all purchases and transfers are captured in one giant government database. But what about the potential for abuse that could come if a government had the power to “cancel” individuals’ money.

Imagine going to a protest and the next day your money doesn’t work at the grocery store because the government has “cancelled” it.

Private cryptocurrencies offer an alternative to government designed digital currencies, acting as a check against excessive government power.

Adding Physical Rules to the Internet

The invention of Bitcoin wasn’t some simple act like the printing of monopoly money. It involved overcoming a long-standing mathematical problem call “The Byzantine Generals Problem.”

Solving this problem allowed digital property to be recorded and verified, without:

- a trusted notary

- a trusted central authority to save the ownership records

If a music label had designed the system, the company would have required that musicians have a music label which acts as an intermediary.

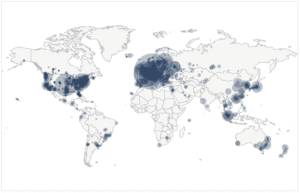

Instead, the creator of Bitcoin designed the system so that anyone, be they a musician or a athlete can transact directly with others, anywhere in the world, so long as they have an internet connection. There is also no need for certified notaries or banks because each party is verified by cryptography and the “banking” records are stored on tens of thousands of computers around the world. Institutions like banks may compete to add value, but they are not required to transfer money between two parties. All transactions are encrypted and happen directly.

The Double Spend Problem

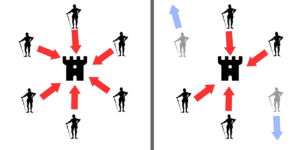

Up until this point, digital currencies required that a central computer keep track of all ownership records to prevent currency from being spent more than once.

You can think of it this way: imagine you take an amazing picture of Yosemite and sell it to me. How do I know that you don’t still own a copy, despite the fact that you sold it to me.

Bitcoin doesn’t require that a centralized authority like the US government maintain the records for all property. Instead, the transaction ledger is mirrored on computers around the world and anyone can inspect the log.

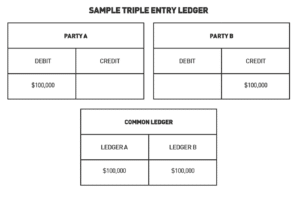

Triple-entry Bookkeeping

Bitcoin is the realization of a new accounting innovation called “triple-entry bookkeeping” in which accounting records are cryptographically signed and copies of the transaction saved externally to the company.

Luca Pacioli (1446-1517) is credited with documenting the double-entry book-keeping system. Double-entry accounting was adopted as a more-trustworthy way of accounting for the business of renaissance-era merchants and traders than the single-entry method of accounting previously used. Five hundred years later, we are at the beginning of a new era — the age of triple entry accounting.

In the 20th century, after accounting was computerized, people “tried to push the double-entry system to the next level” using what is called “triple-entry bookkeeping”. The name “triple entry” can be misleading because there is no third column. Instead, a company that uses triple-entry bookkeeping agrees to store their books externally to their company, such that the transactions can not be modified because they are timestamped and cryptographically signed:

So, instead of individual firms having their own books for the transaction, they go through a contract which evidently includes every aspect of a transaction; what the product was, who is the seller, who is the buyer, etc. and above all, it’s digitally signed.

In the Triple-Entry Accounting system, all accounting entries are cryptographically sealed by a third entry and thus, it works as a deterrent towards manipulations and financial fraud. In traditional Double-Entry Accounting a company’s ledger can be compromised by any of the weak human links, may be an employee or a bookkeeper or even an auditor. But this unique system of Triple-Entry Accounting leaves no space for any corrupt, weak human link as it is immutable.

The problem with triple-entry accounting, when it was proposed, was that there were technical barriers that needed to be overcome before such a system could be implemented. Or rather, to describe the barriers as “technical” is actually an understatement. A more accurate way of describing the problem is that we didn’t have the mathematical knowledge to design such a system.

Mathematicians referred to this class of problems as an example of the Byzantine General’s problem, described by Leslie Lamport, Robert Shstak, and Marshall Pease in 1982.

Bitcoin Pizza day

There are people who assume that Bitcoin was started as a get-rich quick scheme. This is clearly not the case if you read the anonymous creator’s writings. These conversations are focused on the technology and fiscal policy. If you believe the critics, it should also come as a surprise that for the first year3 of existence Bitcoin was not sold and had no monetary value.

In fact it wasn’t until 16 months after Bitcoin’s creation that the first actual purchase was made in the real world using Bitcoin in what is now commemorated as “Bitcoin Pizza day“. On May 22, 2010, Laszlo Hanyecz became the first person to use Bitcoin to purchase something in the real world when he paid 10,000 Bitcoin for 2 large Papa Johns pizzas which cost about $41. This is equivalent to less than half a cent ($0.0041) per Bitcoin. Today at a price of around $50,000 per Bitcoin, the 10,000 Bitcoin purchase could fetch $500 million and buy 2.4 million pizzas.

Why did Bitcoin rise in price so much?

Bitcoin started out as an unknown and untested piece of software. It was only after Bitcoin gained market share, proved the superiority of its software technology, and survived numerous threats that retail investors started to put sizeable money into Bitcoin. Once early adopter individuals had tested Bitcoin, early adopting institutional investors began to make purchases, fueling the price’s rise.

Perhaps the most significant factor I’ve understated is that demand for Bitcoin rose as faith in financial and political institutions fell. Many Bitcoin buyers purchased a small amount of bitcoin (what they could afford to lose) as a narrative developed that Bitcoin currently functions not as a currency but as “digital gold” — a hedge against central banks’ money printing.

Because Bitcoin’s code increases the money supply on a computerized automatic schedule, Bitcoin users can be confident that it will not be debased, unlike the dollar and euro.

Volatility: Bitcoin as a Small Startup like Google or Amazon

Imagine a small computer company that sells software or an internet bookseller. If you held stock in Microsoft or Amazon in the early days you wouldn’t be able to sell it for very much. But as the company gained market share and proved itself able to survive ups and downs, the stock buying public became more confident in its value.

In the dot-com crash:

Amazon’s stock tumbled month after month as well, losing more than 90 percent of its value in two years.

Amazon stock, like Bitcoin was very volatile, losing more than 50% of its value on multiple occasions.

Generally speaking, volatility decreases as companies grow larger and more mature. We’re still in the very early stages of Bitcoin. Bitcoin is still very small in comparison to the dollar and its future is relatively uncertain. Were Bitcoin to grow to its full potential and become recognized by governments as an established part of the economy, volatility would decline and it would become more suitable for use as a currency.

But today, uncertainty over Bitcoin’s future, especially its treatment by the goverment adds to its volatility.

The 2017 Bitcoin Schism

In 2017, there was a schism within Bitcoin over the question of whether Bitcoin should modify its code to become a payment-centric system like VISA or keep its initial configuration and handle payments as a secondary layer of the protocol. Investors like Raul Pal, who had held Bitcoin up until this point, sold out of fear that a split would destroy the value of both.

The ensuing split ended up strengthening Bitcoin when the fork failed because it proved that future splits are unlikely to succeed and that the community could self-govern.

If you hear someone say that Bitcoin can only perform 7 transactions per second while VISA can perform 40,000 transactions per second, you’re talking with someone who is unfamiliar with the 2017 debate about how Bitcoin should scale.

Today, VISA offers the ability to work with Bitcoin and companies like Strike offer the ability to transfer Bitcoin via the Lightening network. The Lightening network has the capability of processing 1 million transactions per second and is easy to use if you are comfortable with cell phone apps, but many people are still not comfortable with phone applications.

Jack Dorsey has said that he intends to build the Bitcoin Lightening network into Twitter, making it possible to make micropayment tips to content creators.

Bitcoin Governance

In 2017, the Bitcoin community rejected a change proposal that Bitcoin’s configuration be changed to allow more transactions per second on the base layer. They did this because doing so could result in it becoming too expensive for the average person to run a node that stores and verifies all transactions. While some critics have dismissed this objection as trivial, keeping computer requirements accessible has become a valued principle in enabling Bitcoin’s popular governance. Bitcoin’s strength comes from he fact that there is a community of over 10,000 nodes which verify new transactions. If Bitcoin is to scale, the community requires that it do so while under the close oversight of the Bitcoin community.

Replacing the Federal Reserve

The more you learn about Bitcoin, the more you learn about our existing financial system. So if you talk to a Bitcoiner, you’ll find that they are much more knowledgeable about our finance system than the typical person.

To answer the earlier critique about VISA’s 40,000 transactions per second, Bitcoiners will correctly tell you that VISA is only a small part of the financial system that depends upon banks such as Ephrata National, Fulton, and Bank of America. These banks are in turn dependent upon the Federal Reserve System.

Suppose I buy:

- $100 drill at a local hardware store which banks at Ephrata National, a

- $5 burger at local diner which banks with Fulton, a

- $4 coffee every day at Starbucks which ~banks with Bank of America x 30 days, and

- $20 groceries at Walmart which ~banks at Bank of America

Monthly aggregation

My month’s 33 transactions are combined with every other Fulton customer and aggregated into a few large payments. This way Fulton avoids the need to send so many transactions over the Fed Wire system when they make payments to Ephrata National and Bank of America.

Although Bitcoin started out using many small, less secure transactions, Bitcoin today is less like VISA and more than like the Federal Reserve system, whose transactions cost $25 for a wire, and which can handle ~25 transactions per second.

- Fed Wire transactions can be made with anyone on the Fed system and take between several hours – 1 day.

- Bitcoin transactions can be made with anyone on the internet and take 10-30 minutes.

The Bitcoin Whitepaper

Let’s return to the story of Bitcoin’s origin by observing that Bitcoin first came into existence not with the hype of a video or marketing campaign, but as a academic-style paper which proposed a solution to a mathematical problem call the Byzantine General’s problem.

Someone who wanted to make money off a a discovery would not announce their idea before they had the opportunity to capitalize off of it, but the inventor of Bitcoin solicited feedback from other computer programmers and then released the code that implemented this design for free.

Bitcoin has sometimes been called a scam, but the creator of Bitcoin gave away the idea and the code that implemented it and has not cashed in any of the Bitcoin that they retrieved in exchange for dedicating their computing power to act as a server.

How would a new Currency be Implemented Fairly?

If you were to introduce a new currency to the world, how would you assign the first money fairly? Some “cryptocurrencies” have awarded their creators and other insiders with shares. With publicly traded companies there always seems to be people that are given preferential treatment when an IPO (initial public offering) is made.

In our current banking system, banking and corporate insiders are given preferential treatment. There’s a term for this — the cantillion effect: So money gets to the rich first. Eventually, some money will get to the rest of us

.

Let’s contrast this to the Bitcoin allocation — Of course, at minimum, all early Bitcoin recipients had to be aware of the project, but Bitcoin was designed to allocate new Bitcoin only to those who provided a service by running server nodes to power the network. I view this as one of the fairest possible ways to allocate a new currency.

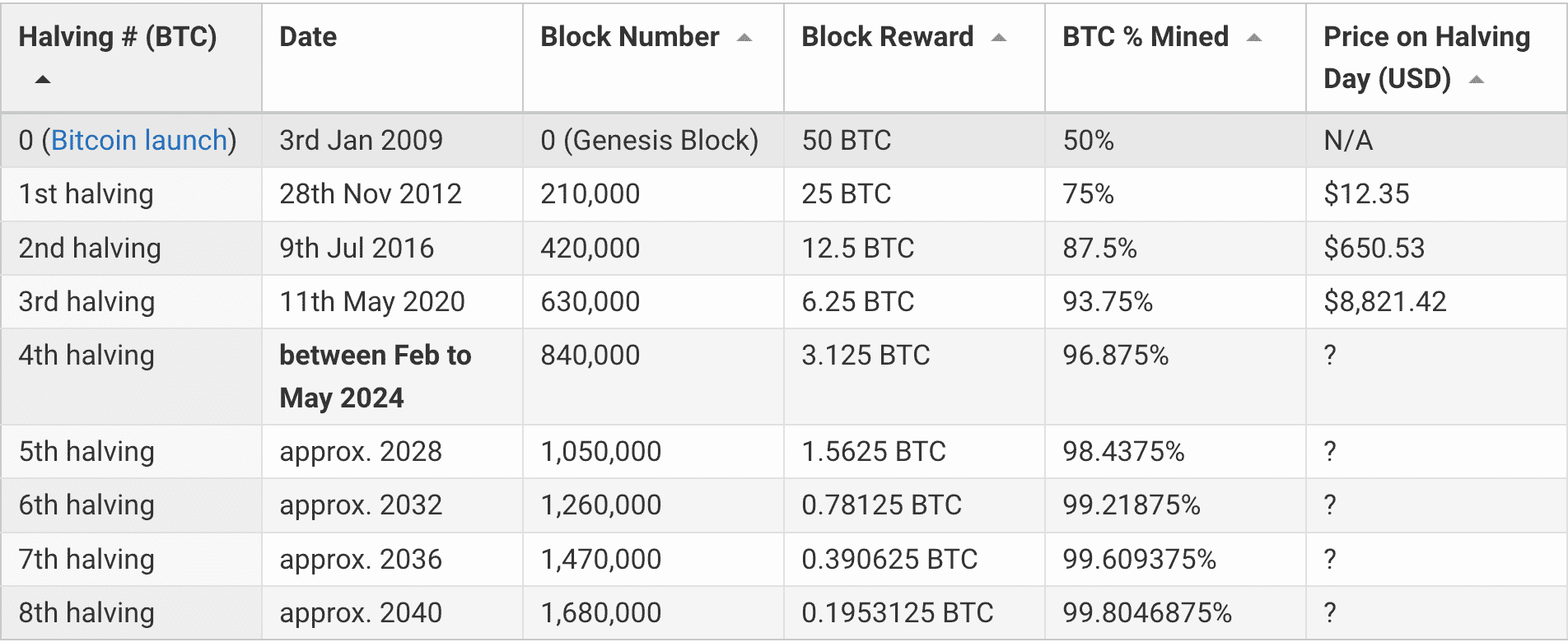

Even today, all new Bitcoin comes into existence as a reward to those people whose servers act as virtual “notaries” to verify the transactions. Every 4 years the reward for these miners decreases by half until in ~2140 when there will be no more new Bitcoin issued.

A Declining Inflation Rate:

This schedule of mining rewards being cut in half every four years results in an inflation rate that shrinks until the inflation rate hits zero in 2140.

This makes the existing Bitcoins more valuable if demand for new Bitcoin outstrips supply, causing the price to go up.

#Bitcoin NgU Technology pic.twitter.com/SMSYb2jhHe

— PlanB (@100trillionUSD) December 16, 2020

This Bitcoin Halving Cycle is responsible for quite a bit of the price volatility. This is “by design” and the volatility attracts a lot of attention. Bitcoiners use the term “Number go up Technology” and those “in the know” anticipate that NGU technology (and volatility) will decline as Bitcoin matures and the halving becomes smaller and smaller.

Transactions are Public, but Pseudo-Anonymous

New technologies attract innovators and some of those innovators are criminals. Some of the first pager users and cell phone users were drug dealers. Yet that doesn’t prove that the technology of pagers and cell phones itself is illicit or that the criminals will continue to outpace law enforcement.

When Bitcoin first started, many of the early users were engaged in illicit activity. This reputation has persisted, despite the fact that the FBI has gotten very good at catching money-laundering and other illicit activity that takes place using Bitcoin.

The Bitcoin ledger records the sending and receiving user’s identity, but rather than listing the name, a very long ID number is used, which prevents the casual user from discovering the identity of those transacting. While you and I may not recognize the User ID, the FBI has gotten very good at matching ID numbers with their real-life owners. All American crypto exchanges are required to tell the FBI the identity of their customers and all the smart criminals have learned that it is a bad idea to use Bitcoin in criminal transactions.

The FBI would much prefer that criminals use Bitcoin instead of cash because, like Facebook, the government is then able to see all their friends and associates. A former acting FBI director has said that were all criminals to use Bitcoin, money-laundering could be virtually entirely shut down.

The danger to criminals of using Bitcoin can be illustrated with two stories:

FBI Catches Drug Sellers using Bitcoin (and their own agents)

Back in 2013 when people were buying and selling illicit items on an exchange called the “Silk Road”, the FBI investigated and caught the kingpin behind the black-market organization. Unfortunately, a large amount of the Silk Road’s Bitcoin was stolen by the FBI’s own agents. The FBI would normally not have discovered that 2 of their own agents were behind the theft because these agents were experts in hiding their tracks and they had authorization to contact Internet Service Providers and tell them to delete any incriminating logs.

But deleting internet logs is much easier to do than deleting Bitcoin logs.

Every Bitcoin transaction is mirrored and verified by over 10,000 server nodes. If the rouge FBI agent wanted to hide their information, they would need to locate all 10,000+ nodes and the some million copies located around the word and break into and modify them simultaneously to change the blockchain.

Both FBI agents were caught because, at the time, both FBI agents and criminals had not learned the risks of committing fraud with Bitcoin. You may hear about criminals that extort businesses using ransomware. The issue with ransomware is not that the FBI can’t track them, but that their own governments refuse to extradite them or cooperate in their prosecution.

Bitcoin has less money-laundering

Since the Silk Road, criminals have come to realize that it is not a good idea to transact on a system that stores a public record of every transaction. Former Acting CIA-director Michael Morell was under the impression that illicit activity on the Bitcoin network was still high, but when he was commissioned to perform An Analysis of Bitcoin’s Use in Illicit Finance he was surprised to find that the rate of illicit activity was less than half that of the tradition banking system.

What is FUD?

In the 1970s, IBM developed a strategy that came to be known as FUD:

- fear

- uncertainty

- doubt, or disinformation

“Nobody gets fired for buying IBM” is a phrase anyone working in technology has come across.

This adage implied that those who chose an IBM competitor were risking their careers and that the safe choice for any project was to choose IBM.

In the 1990s, Microsoft picked up the FUD campaign and applied it to IBM, Caldera and, open source software.

Today we’ve all heard about Linux and open source software and seen it used by businesses. Apple built its beautiful user interface on top of free and open source software like BSD , but at the time, Microsoft implied that those who used FOOS (Free and open source software) were in legal jeopardy because FOSS infringes on no fewer the 235 Microsoft patents

and the “viral nature” of the GNU General Public License (GPL) poses a threat to the intellectual property of any organization that derives its products from GPL source

.

Remember how I told you to be wary of the arguments you hear about Bitcoin and cryptocurrencies because those making arguments are doing so in a self-interested way. Some of their arguments may seem sensible to you now if you’re not very familiar with the technology and history, but most of these arguments are FUD — fear, uncertainty, and disinformation.

Bitcoin aims to become “open source money” (eventually)

Bitcoin started with the goal of creating an open source money that is independent of governments and the banking system. With Bitcoin, two people can transact directly.

The code to Bitcoin is open source and the creator of Bitcoin chose not to patent their discovery, or profit from its creation.

We are still in the early stages of Bitcoin where volatility and the profit potential to be had from holding are high. If you choose to invest, you should only invest what you can afford to lose and expect to hold the asset for at least 5 years. You should also expect the price to collapse 50-70% several times during that period even if the the overall price appreciates. If you speculate, don’t do so with borrowed money because the volatility can easily liquidate your positions.

Bitcoin is being used as actual spending money only in those areas of the world where the existing monetary options are bad — such as Venezuela, or in places were the fees for sending remittance money are high enough to discourage use of the traditional financial system.4. Another benefit Bitcoin offers holders in developed countries is that it can be easily transferred electronically via the Lightning network. This avoids the need to take a bus ride to deliver money to friends, family, and creditors.

One acronym you will hear is that long-term savers are termed “HODLers“, which stands for:

- Hold

- On for

- Dear

- Life

due to the tenacity needed to persevere in the face of a volatile price.

Bitcoin Maximalists vs Pragmatists

Bitcoin Maximalists are those who believe that Bitcoin will replace all fiat currencies as well as all cryptocurrency competitors. By contrast, the pragmatists do not push for this, accepting the possibility of a digital dollar that is even more widespread than our paper dollar, but with Bitcoin filing the role of digital gold and also replacing negative-yielding bonds.

Why is Bitcoin worth anything if it has no intrinsic value?

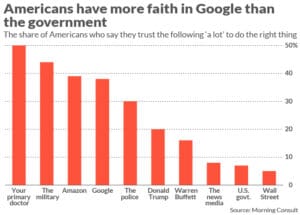

If people had faith in existing political and economic institutions, Bitcoin’s only value would be the technological advance its technology offers.

Bitcoin’s main value is its ability to credibly implement a non-inflationary monetary policy.

What intrinsic value does the US dollar have? The paper that dollars are made of is higher quality than monopoly money but a currency is no longer a currency if dollar bills are burned to stay warm.

It is true that dollars can be used to pay taxes, but for those skeptical of government finances this is not enough to uphold confidence.

We can expect a digital dollar to have the same weaknesses as the paper dollar — an inflationary monetary policy weighed down with large amounts of debt.

The advantage of hedging oneself with small amounts of Bitcoin is that the Bitcoin stands a chance of holding or increasing its value. And if one only puts in a small percentage, the downside risk to one’s portfolio is limited.

Asset Inflation and Financial Corruption

The main objection that Bitcoin investors have is to a corrupt financial system in which financial insiders get preferential access to the Federal Reserve. (Further objections)

If I were the CEO of AT&T, I could invest the company’s money in productive assets and attempt to earn a return on my investment. But in the past decade companies like AT&T have borrowed money from the Federal Reserve (issued bonds that the Federal Reserve bought) and used that money to purchase their own stock. I noted in a February 2020 article (before Covid) that corporations were the largest purchaser of their own stock. This allowed the CEO to achieve their target numbers, for which they were rewarded with a bonus.

The whole stock market “recovery” since 2008 has been financed by federal reserve borrowing. One may see the price of stocks and houses appreciate and think things are going well but what is really happening is the federal reserve’s purchases have inflated the value of assets like stocks and houses.

It is corruption for corporations like AT&T to get to borrow at such low rates while individuals face much higher rates on their credit cards and loans.

Bitcoin is going to bankrupt Western Union

For remittances, Bitcoin’s Lightening Network is faster, works anywhere, and much cheaper.

“Cutting out the middle-man” is on of the main themes of Bitcoin.

Bitcoin is not “backed” by anything.

The dollar used to be backed by gold, but now it is backed by oil through the US-Saudi petrodollar alliance.

Bitcoin, by contrast, is backed by electricity, in the sense that electricity is a large part of the cost of producing new Bitcoin. This arrangement is better for the environment, because electricity unlike oil can be produced by renewable sources like solar, winds, and hydro.

Can Governments Stop Bitcoin?

Raoul Pal says that the major government powers know that they can’t stop Bitcoin, but they are going to attempt to slow and regulate it. They’ve already passed laws requiring those who convert dollars to Bitcoin to collect identifying information on those transfers. This aids them in another important goal of theirs — taxing the sector.

If you are saving Bitcoin or other cryptocurrencies for retirement, it is possible to do so as part of a Roth IRA which shields the proceeds retirement assets from taxation.

I’ve heard some people (who I assume are Bitcoin Maximalists) argue that ultimately the US will have to accept Bitcoin, but that they don’t want to do so until the powerful have had time to adjust their holdings and put new rules in place.

Decentralized Financed: De-Fi

One of the under-appreciated aspects of cryptocurrencies like Etherium is that they aren’t just a currency or crypto-asset, they actually represent a decentralized computer which has the potential to run an entirely new financial system.

Users of Etherium can participate in computerized contracts which let them lend money and earn interest. The interest rates for De-Fi (Decentralized Finace) are substantially higher than traditional banks which typically give very little interest. (They are also substantially more risky.) This has the potential to put many banks out of business and I suspect the government will try to slow the advance of De-Fi, out of a desire to protect the banks.

Global Warming: does Bitcoin use too much electricity?

Raoul Pal says that the Europeans are using Bitcoin’s energy usage as a talking point to slow Bitcoin’s adoption. Bitcoin uses roughly 0.1% – 0.5% of the world’s electricity, which can sound like a lot when you compare it to a small country like Sweden, but YouTube uses 6 times as much energy as Bitcoin.

The issues with Bitcoin depend on whether you think existing government-provided currencies deserve a competitor that has a guaranteed monetary inflation rate and attempts to preserve some privacy. If this has value to you, you may judge the energy to be well-spent!

The other thing about Bitcoin’s energy use is that Bitcoin can use “stranded energy” that other users are unable to use. A hospital or office does not readily tolerate power interruptions, but Bitcoin miners are able to make uses of intermittent and variable power, such as that generated by wind or solar.

The other advantage of Bitcoin is that it can harness the power of natural sources that are too remote to be connected to the power grid. Thus, Bitcoin is not competing with existing users of energy, but like an old farm dog, living off the scraps it can find.

Bitcoin proponents argue that by providing a “market of last resort” to wind, solar, and hydro generators, Bitcoin functions as a new monetization stream, increasing the pace at which renewables can be made profitable, and thus the speed at which they can be deployed.

Another misconception is that Bitcoin usage will grow exponentially as usage grows, but this is not the case. If Americans were to use 10 times the number of purchases, it would not pose a challenge to the Federal Reserve Banking system. VISA would have 10 times the number of payments to process, but they would still aggregate to roughly the same number of transactions needed to clear with other banks.

Bitcoin’s growth will scale the same way, using a similar number of transactions in larger amounts.

The other thing to realize about Bitcoin is that mining new Bitcoin takes much more energy than actually using existing Bitcoin. It takes much less energy to transact with an existing coin; and new coins are being created at a slower and slower rate, halving every four years.

Is there going to be US digital currency?

In an earlier article I quoted former FDIC chair Sheila Bair as predicting that a digital dollar could be possible in 12-18 months. It seems to me as though the limitation is not the technical capability but the government’s interest in overcoming the banks’ resistance to a digital dollar.

The Fed has the potential to cut out the banks from a lot of their business and offer accounts from the Fed directly. Banks would still serve businesses but customers with simple needs would not need a private bank. This actually creates an incentive for some banks to offer Bitcoin to their customers, as a way to compete with or pre-empt a central bank digital currency.

One big “advantage” of this for the Federal Reserve is that they could give account holders negative interest rates (meaning they could charge you for keeping money in the bank) as a way to stimulate the economy when the economy is in recession. Since the money would be digital, there would be no way of pulling money out of the system and avoiding the negative rate. You can’t hide your digital dollars under your mattress.

My impression is that the US will be slow to create a digital currency, and when it does so it will be based off private blockchains like Etherium or Cardano.

Who do you trust to create your digital currency?

It should be welcome news that the US Government may not develop its own digital currency for those who fear a tyrannical government could exert greater control over society through a cryptocurrency. Most of the existing cryptocurrencies have been designed by liberty-minded computer programmers as a check against government power.

For Christians wary of prophecy in the book of Revelation, the fact that the earliest cypherpunks were libertarians should also come as a relief.

What about the 8,000 other crypto currencies?

It is true that many of the thousands of lesser cryptocurrencies are likely to meet the same fate as the dot-coms. But that doesn’t take away from the fact that a crucial few dot-coms grew into major players like Google and Amazon.

The other thing to understand about all theses other cryptocurrencies is that some of them are designed to serve other purposes:

Etherium and Cardano aren’t just currencies, but function as virtual computers that can run and enforce contracts. In the US, these services may not be as attractive to Americans because we already have a developed financial, but in the developing world they could find a large market. Here’s an example of how an insurance contract would work:

A farmer in Africa wants to insure their crops against drought.

They find an insurance contract which offers a payout if rainfall and temperature records meet certain criteria.

They purchase the insurance contract for 0.05 Etherium.

The Etherium using another “cryptocurrency” called Chainlink which provides the computing machinery to connect to the weather service‘s webservice.

If the weather webservice reports temperature and rainfall amounts that match the contract, the Etherium cloud servers will pay out the terms of the contract to the farmer, immediately.

This financial arrangement does not require the intervention of an individual and is not subject to interpretation by an insurance company and subject to delay.

In developed countries, we may prefer to deal with people, but in areas without institutional capacity or where institutions are untrusted, this may be a valued option.

What is a fair valuation?

Even if you accept that Bitcoin makes sense as a technology doesn’t mean that it is worth a particular price. Speculators often bid up the price by purchasing Bitcoin on margin (with borrowed money). This creates a bubble, which from time to time will be “popped” and Bitcoin prices will fall sharply.

Risks for ownership

Bitcoin’s biggest risk is that the governance and financial situation improves enough that the Federal Reserve is able to get its balance sheet under control. But a homeowner who purchases fire insurance is not unhappy that their house did not burn down. I would be perfectly happy to see my Bitcoin position liquidated if the government shaped up.

Bitcoin can be thought of as a hedge against financial shocks that cause the Federal Reserve to buy up debt:

- If inflation rises, the Fed will buy up the government’s debt (treasuries) in an attempt to suppress interest rates (This is called Yield Curve Control).

- If the economy goes into recession and deflation arrives, the Fed will likely buy more bonds as part of quantitative easing.

- If foreigners reduce their purchase of the government debt, the Fed will once again step into the market and buy the treasuries directly. (This is called Monetizing the Debt and can be thought of as running a restaurant where you are your own customer)

Everyone has a different personal inflation rate

Paul Krugman says that he still thinks that inflation will be transitory, but its important to clarify that he is speaking of CPI: consumer price inflation.

The thing about the actual inflation rate — everyone has their own personal inflation rate. I’ll illustrate with the following examples:

Home

Suppose there is a 25-year old named Joe who lives in their parents basement for free, with food provided for free, free access to a car, and living off of their parents health insurance.

The only prices Joe cares about are the cost of alcohol and marijuana, as those are the only things he pays for. Joe doesn’t care that the price of beef or chicken is up, as his parents provide for his food.

Apartment

Then one day his parents tell him he needs to find his own apartment. Joe now cares about the prices of apartments, and food, although he can still stay on his parent’s health insurance for free.

Kids

As Joe gets older, he has to buy his own health insurance and if he has kids he starts to care about the cost of their education.

Asset Inflation Rate

If Joe wants to save for retirement or any other reason, asset inflation will result in him buying fewer years of retirement income with a given amount of savings.

| Category | % Rate | Amount | Notes |

|---|---|---|---|

| apartment (rent) | 9% | $1,340 | 1,031 sq. ft. |

| meats, poultry, fish, and eggs | 5.9% | CPI-U | |

| dairy | 1.8% | CPI-U | |

| college education | 4.2% | 54,379/year | US News & Report Liberal arts colleges, 2018-2019 |

| hospital services | 2.8% | CPI-U | |

| assets: stock market | 23% | Dow Jones | |

| assets: housing | 13.2% | $287,148 | US nationwide |

| assets: savings | 0.06% | Bankrate survey | |

| Average consumer price index | 5.4% | Overall CPI |

More Information:

- Inventing Bitcoin: (free) The Technology Behind the First Truly Scarce and Decentralized Money Explained, by Yan Pritzker (haven’t read)

- Trader University: Matthew Kratter’s Youtube Videos

- The Bitcoin Standard: (book) how the Bitcoin monetary system works (compare with Gold Standard, haven’t read).

- The Fiat Standard: (book) how the current monetary system works. (haven’t read)

- Coinbase: sells Bitcoin as well as crypto

- Swan Bitcoin: guides you through purchasing Bitcoin

<< Back: Main

Yes, the “NFT” is not a name a savvy marketer would pick. ↩

Digital assets are not confined to images. Music, videos and 3-dimensional objects found in computer games and virtual worlds can also be sold digitally↩

Jan 3 2009 (Genesis block) – May 22, 2010 is Bitcoin Pizza Day ↩

When sending money to their families, many migrants pay 1/12th of their annual salary in fees. This means that they are working one month out of the year to pay bank fees.↩