How do Transactional People Think?

After Barack Obama was elected President, Illinois Governor Rod Blagojevich had the power to appoint Obama’s successor to the senate.

Being a “transactional” sort of guy, Governor Blagojevich, wanted to use what he had to maximize his own interests.

I got this thing and it’s f**** “golden”:

FBI agents recorded Blagojevich conversing with an adviser:

I’ve got this thing and it’s golden and I’m just not giving it up for nothing

- a salary for himself and ($250,000-$300,000)

- a position on a corporate board for his wife (~$150,000/year)

- campaign funds, with cash upfront

- a cabinet post or ambassadorship

Pardoned by Trump:

After he was impeached by the Illinois Senate, he was indicted and convicted in Federal Court and sentenced to 14 years in prison.

Blagojevich was unrepentant and protested his innocence, serving 8 of those 14 years, before being pardoned by President Trump.

What will Trump want in exchange for him leaving office?

Now it is still possible for Trump to fairly win the upcoming election. But if he doesn’t win legitimately, will he go quietly?

I assume that Trump does not intend to give up the Presidency for “nothing” if he loses and that a lot of the choices he makes are about strengthening his hand and developing a narrative.

How much will Democrats be willing to pay, in money and otherwise, to have Trump leave office? And what will be Trump’s ask? Here’s my guess:

What will Trump ask?

- Legal absolution: scuttle all the sealed indictments and future court cases against him.

- Stop damaging disclosures: If not already public, silence unfriendly attention regarding tax returns, etc.

- Financial Bailout/fleecing His hotels and golf properties haven’t done well financially lately. I don’t know the state of his financial need, but he seems to take pride in finding creative ways to fleece the taxpayer. Expect financial demands.

- Honor: recognition of his status as a great President. Maybe a monument, naming rights to a building, etc.

- Attention: Trump would likely want to host his own show or own his own network. He needs to see a future for himself after the presidency.

- Nepotism: Donald wants his family name to remain relevant so he may want some benefit, particularly for Ivanka, his favorite child.

- Victimhood: Trump will need an excuse for why he didn’t get a second term both for himself and his supporters. If defeated, like Blagojevich, he can not admit it. The only way he will agree to relinquish power is under the condition that he can still insist that he was a victim and the election was rigged.

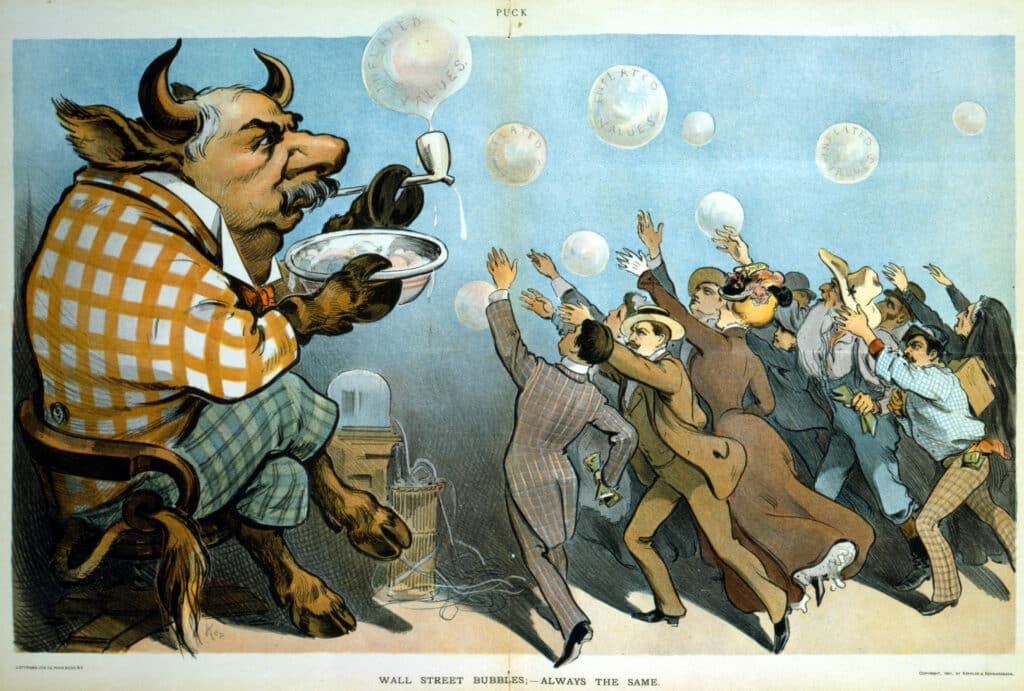

What will Trump Threaten?

The basic idea to keep in mind is that Trump is less concerned about the peaceful transfer of power than the Democrats are. Trump has an affinity for chaos and that he will use that as leverage.

What do you think?

Everyone expects that Joe Biden will concede if he loses.

But if Trump loses but not in a big way, will he readily accept defeat?

If not, what will Trump ask and what will he threaten?

P.S. Why is it that this sort of politician seems to have a thing for having a full head of hair?