What is Bitcoin Good for? > Bitcoin is more like the Federal Reserve than like VISA

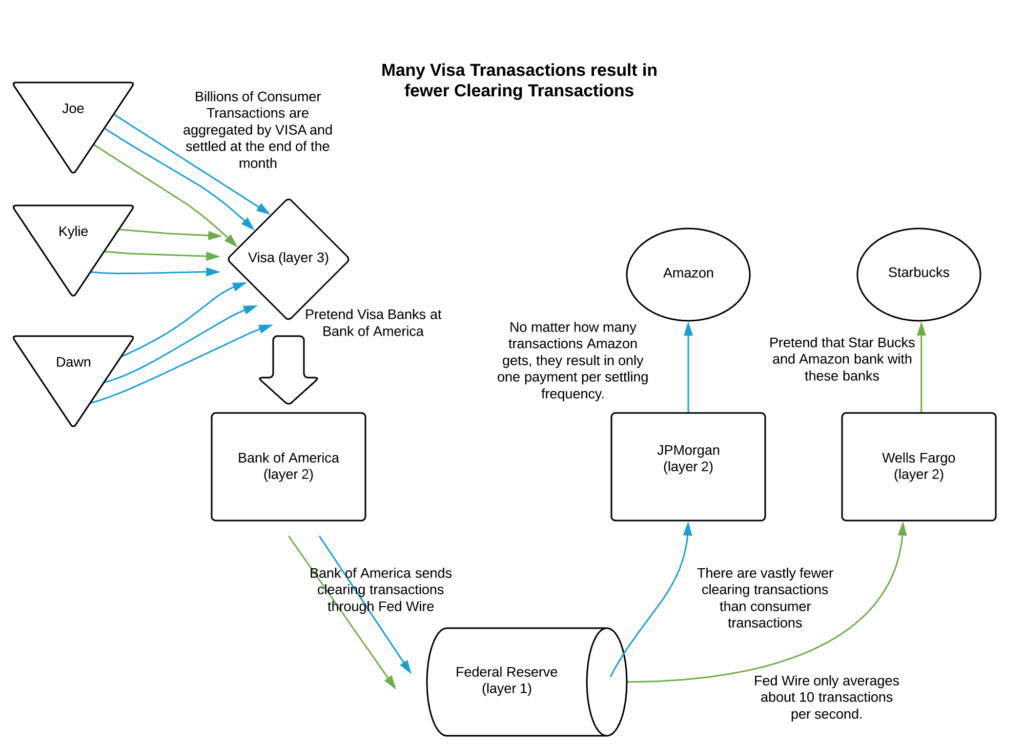

- Banks are build on top of the Federal Reserve clearing system. (Layer 1)

- Payment systems like VISA (layer 3) are build on top of the banks (layer 2), (which are built on top of the Federal Reserve system.

- Millions or Billions of VISA Transactions on layer 3 are aggregated in vastly fewer, but much larger Fed Wire transactions on layer 1.

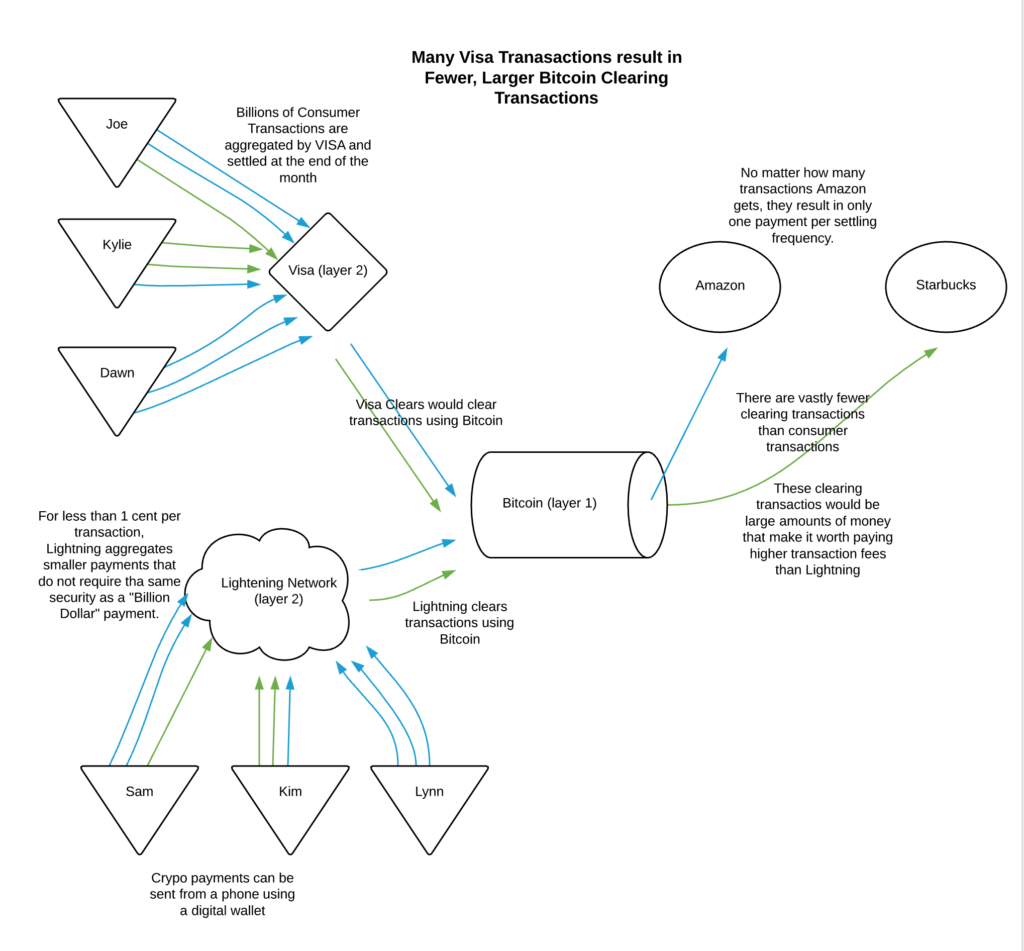

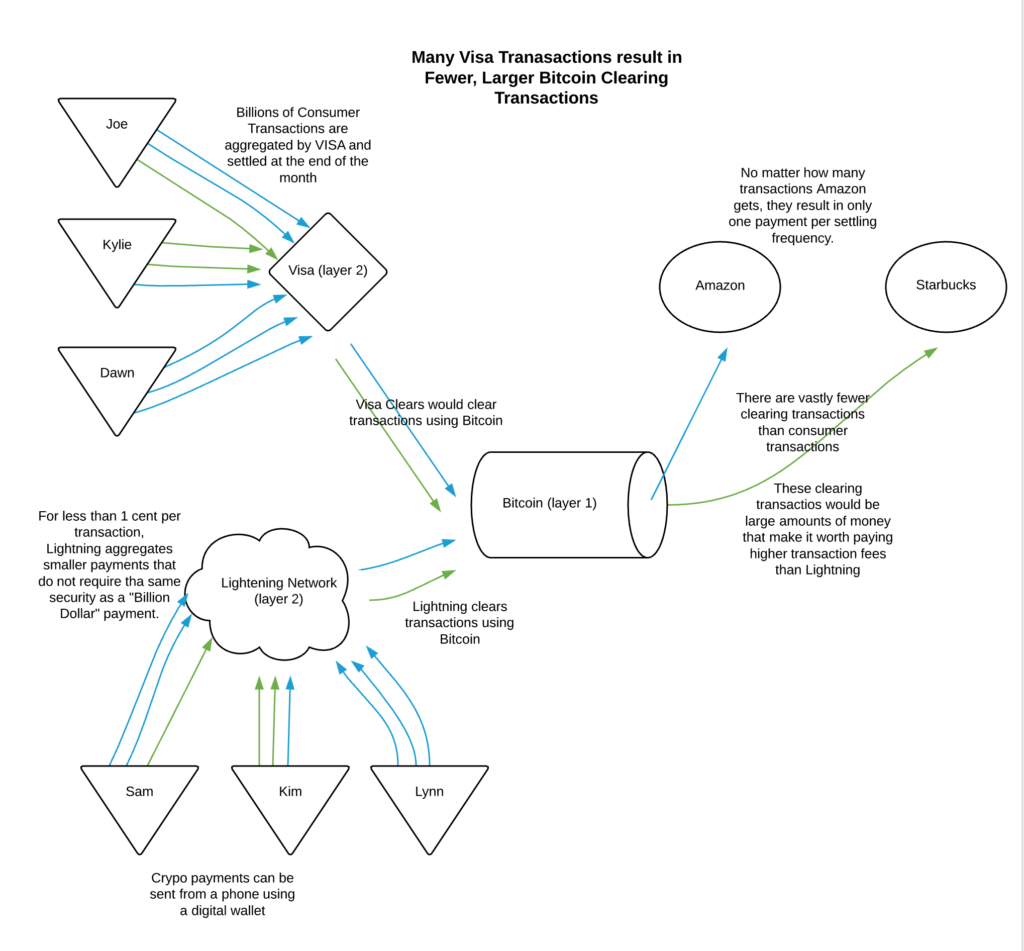

- If Bitcoin competes with the Federal Reserve as a Layer 1, VISA could operate as a layer 2.

- With Bitcoin as layer 1, Lightning functions as a layer 2 competitor to VISA.

- Millions or Billions of VISA and Bitcoin transactions are aggregated into fewer, but much larger transactions.

More likely, the Fed and Bitcoin will coexist and VISA will settle transactions with each.