An orgy of borrowing, speculation and euphoria has left the markets on the verge of catastrophe

Financial markets have experienced the fastest ever crash over the past few weeks. Even during the dotcom bust and the Lehman crisis, stocks did not fall this quickly. In less than a month, we have seen major indices fall almost 30%, and stocks in sectors such as oil and travel down by 80%. We are experiencing terrifying daily declines not seen since the 1929 stock market crash that preceded the Great Depression.

We are at a watershed moment: the coronavirus Covid-19 is a catalyst fast bringing many long simmering problems to the boil. It is exposing the creaking financial systems around us and it will change the way economies function. Economic and financial pundits, however, have been focusing almost exclusively on the short-term effects of coronavirus and so are missing the much bigger themes at play.

Epidemiologists tell us that when it comes to the virus, we are looking at a once in a century event. It is highly contagious and highly lethal. Experts are not comparing Covid-19 to SARS or Swine Flu, but to the Spanish influenza of 1918 that killed between 50 and 100 million people worldwide.

We do not have good data on what the stock market did during the 1918 flu, but we do know that it led to a severe recession. The connection between influenza and recessions is well documented. Going as far back as the Russian flu in 1889-90, the Spanish flu in 1918, the Asian flu in 1957-58 and the Hong Kong flu of 1968-69 — they all led to recessions. This one will be no different.

But this recession will not only be driven by the economic loss of able-bodied workers, it will be helped along too by the steps political leaders take to avoid the spread of the coronavirus. In medicine, the immune system’s response can often be worse than the disease. When the body goes into septic shock, the immune system overreacts, releasing what doctors refer to as a cytokine flood, which can reduce blood to vital organs and lead to death. Sepsis is common and kills more than 10 million people a year. Today, the political reaction to Covid-19 is causing something akin to a septic shock to the global economy.

The recession is likely to be very sharp and but brief. Recessions are self-regulating. De-stocking of shelves and warehouses leads to re-stocking. Collapsing low interest rates and oil prices eventually spur spending and borrowing. Government spending and central bank easing eventually feed through to the real economy. While there will be massive panic and bankruptcies today, there is little doubt that markets will be better in a year, and certainly will be in two to three years,

But the structural changes to how our economy operates, however, will be felt for decades to come. And this is in large part because we didn’t learn the lessons of the last crash.

Over the years since the 2008 crisis, central banks have been trying to stamp out every single small fire that flares up (the European crisis in 2011-12, the Chinese slowdown in 2015-16, the slowdown last year); but suppressing volatility and risk only creates bigger fires. Risk is like energy and cannot be destroyed. It can only be transformed.

Forest fires are a useful analogy. California has infrequent, devastating forest fires; the Mexican state of Baja California has many small frequent fires and almost no major catastrophic fires. Both states have a similar climate and vegetation, yet they have vastly different outcomes. That’s because when there are very few small fires, underbrush grows, vegetation increases and creates greater kindling for the next fire. Suppressing small risks only makes them emerge eventually as very big ones.

In politics and economics, massive change events tend to happen not in orderly sequences, but in sudden spasms, like the Arab Spring, or the collapse of the Eastern Bloc. Watching events unfold is often like watching sand grains pile slowly on top of one another until a final, random grain causes the entire pile to collapse. People knew the Arab countries were fragile and that the Eastern Bloc might eventually fall, but predicting which grain of sand would do it precipitate either was impossible.

Physicists call these transitions critical thresholds. Critical thresholds are everywhere in nature. Water at moderate temperatures is disorganised and free-flowing, yet at a given critical value, it has an abrupt transition to a solid. It’s the same with the sandpile: one grain too many can trigger collapse — but which one?

In 1987 Per Bak, Chao Tang, and Kurt Wiesenfeld found that while sandpiles may be individually unpredictable, they all behave the same way. The critical finding of their experiments was that the distribution of sand avalanches obeys a mathematical power law: The frequency of avalanches is inversely proportional to their size. Much like forest fires, the less frequent they are, the more catastrophic they are.

It’s the same with financial markets and the economy. We will experience years of quiet, interrupted by sudden avalanche. Years of slowly adding grains of sand can end abruptly — to our great surprise. Today in financial markets, many unsustainable trends have been building, and the coronavirus is merely the grain of sand that has tipped the sandpile.

—

It would be controversial to say that the stock market reaction to the coronavirus would not have been very big had we not been in the middle of an orgy of borrowing, speculation and euphoria. Of course, stocks would have fallen with coronavirus headlines, but it is unlikely they would have crashed the way they did without those exacerbating factors. Furthermore, without enormous underlying imbalances of high corporate debt, the prospect of poor sales would not have driven so many stocks to the verge of collapse.

This aspect of the current crisis has so far gone unreported. But not unmentioned. A few weeks before the crash, Charlie Munger, vice chairman of Berkshire Hathaway and Warren Buffett’s longtime business partner, issued a dire warning, “I think there are lots of troubles coming,” he said at the Los Angeles-based Daily Journal annual shareholders meeting. “There’s too much wretched excess.”

Speculative euphoria was at record highs. As Sir John Templeton once said, “Bull markets are born in pessimism, grow on skepticism, mature on optimism and die on euphoria.” Investors were all on the same side of the boat, and it capsized, as happens in market crashes.

- Investors were buying a record amount of call options, or bets on stock prices rising further. According to SentimenTrader, by early February, “We’ve never seen this level of speculation before. Not even close.”

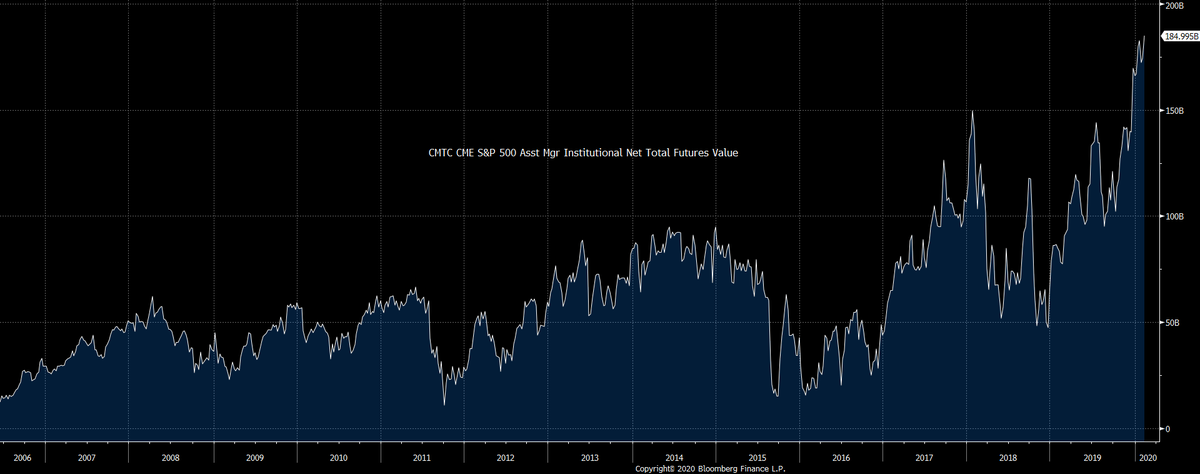

- Asset managers were betting in record quantities on stock futures, which are instruments to bet on underlying indices. Positioning in S&P futures hit a new high as of February 11.

- Hedge fund borrowing to buy stocks was at a 24-month high. They were highly confident markets would keep rising.

It was not a coincidence that there was such euphoria. Retail brokerages had announced over the past few months that they were eliminating all commissions on trading activity. Buying and selling stocks was suddenly “free”. It was like pouring truckloads of kerosene on a blaze. At Charles Schwab, daily average trading revenue exploded 74% after the change.

In scenes reminiscent of the dotcom boom, stocks were doubling overnight. Virgin Galactic Holdings, with no revenue, was worth over $6 billion dollars. Tesla, which has never made money selling cars, had a market capitalisation greater than any other car manufacturer. Its stock price quadrupled in less than three months. The market was so stretched that it would have crashed due to its own absurdity — with or without coronavirus.

The source of this “free” trading came from high frequency trading firms that are supposed to act as market makers, executing buys and sells for clients. Except that they are not really disinterested middlemen; they are running their own trading strategies to make money off retail investors. They execute the order flow of so called mom and pop investors and profit from these “dumb money” retail traders, in the words of Reuters.

The brokerages which sell retail orders receive hundreds of millions of dollars in return from the market makers. This means that, essentially the market makers are bribing the brokerages to profit from retail traders. For example, E*Trade received $188 million for selling its customer order flow last year, while TD Ameritrade made $135 million in the fourth quarter alone. The market makers are willing to pay so much because they almost never lose money — they trade fast and know where the market is going.

As Warren Buffet once said, “As they say in poker, ‘If you’ve been in the game 30 minutes and you don’t know who the patsy is, you’re the patsy.’” Retail is the patsy.

Ken Griffin is the owner of Citadel Securities the biggest market-making firm, and his business is so profitable that he has gone on one of the greatest property buying sprees of all time. In 2015 Griffin paid $60 million for multiple condo units in Miami. He paid a U.S.-record $239.96 million penthouse in New York City, a $122 million mansion in London, and over $250 million in Palm Beach properties. Market making against “dumb money” is a fabulous business.

As the mania deflated in late February, though, mom and pop were abandoned. As the crash started, market makers pulled back and provided less liquidity. Retail investors were left high and dry. It is no wonder prices fell so quickly.

The high frequency market makers have since been pleading for more capital, and rumors swirl that many are experiencing financial difficulties. The illusion of benign market makers looking after retail investors has vanished.

There are echoes here of the old problems from the Lehman crisis; but they have mutated into different forms. During the Lehman crisis, mortgage bonds were pooled together, and insurance companies and pension funds bought them. Today, retail investors have been buying popular funds known as Exchange Traded Funds (ETFs). These are easy to trade and cheap, but they have a fundamental problem. While ETFs have simple tickers like HYG, JNK, LQD that the average retail broker can trade on their screen, they are really holding hundreds of individual bonds inside of them that the investor is unaware of. These bonds are not easy to trade at a moment’s notice and are highly illiquid. But while the ETFs rose slowly and steadily, and investors poured more money in, lulled by a false sense of security.

While the ETF shares trade daily by the second, the underlying bonds are not easy to trade on their own. In the old days, insurers and pension funds bought these bonds, put them away in a drawer and never traded them. Today, though, investors expect instant liquidity from an illiquid investment. Liquidity mismatches are as old as banking itself (deposits and cash are highly liquid, while mortgages and loans are often completely illiquid); the problems of ETFs have been known all along, and the outcome has been inevitable.

As the coronavirus panic spread, the ETFs started trading at big discounts to the underlying value of the baskets of bonds. Markets are broken, and the gap is a sign of how illiquid the underlying holdings really are.

But these ETFs should never have been allowed in the first place. In the words of Christopher Wood, an investment strategist at Jefferies, “they commoditise equity and bond investing in an insidious way which ultimately creates a dangerous illusion of liquidity. True, ETFs are cheap. But so is fast food.”

While ETFs may appear technical and unrelated to the broader problems in markets, they share the same underlying problem. We have had the illusion of safety and liquidity for some time, and it is the coronavirus that has exposed the gaping holes in financial markets.

—

The coronavirus won’t kill companies. But it will expose their bloated, overleveraged balance sheets. Corporate debt in companies has never been higher and has now reached a record 47% of GDP.

Rather than encouraging moderation, central bankers and policy makers have been reloading the all you can eat buffet and persuading everyone to come back for third and fourth plates. The European Central Bank and the Bank of Japan have been buying corporate bonds, and central banks have kept funding at zero rates, which has encouraged a massive increase in indebtedness over the past decade.

Central bankers have long promoted high corporate leverage because they see it as a way to stimulate demand. Even now, many economists see no problems on the horizon. In the New York Times, Nicolas Veron, a senior fellow at the Peterson Institute for International Economics in Washington, was openly mocking anyone advocating prudence, “The prophets of doom who thought that more debt was more risk have generally been wrong for the last 12 years.” Like most central bankers for the past decade, he argued, “More debt has enabled more growth, and even if you have a bit more volatility, it’s still net positive for the economy.”

But while debt has encouraged growth, it has also introduced much greater financial fragility, and so the growth is fundamentally unsound. We are now finding out that less debt, rather than lower rates is better for financial stability.

The global economy has gone mad

According to FactSet, 17% of the world’s 45,000 public companies haven’t generated enough cash to cover interest costs for at least the past three years. Debt has been used to finance more debt in a Ponzi fashion. The Bank for International Settlements looked at similar economic measures globally and found that the proportion of zombie companies — companies that earn too little even to make interest payments on their debt, and survive only by issuing new debt — is now higher than 12%, up from 4% in the mid 1990s.

Entire industries are zombies. The most indebted and bankruptcy prone industry has been the shale oil industry. In the last five years, over 200 oil producers filed for bankruptcy. We will see dozens if not hundreds more bankruptcies in the coming year. They were all moribund with oil at $50 dollars; they’re now guaranteed to go bust with oil at $30.

Only now, belatedly, are groups like the IMF waking up to the scale of the problem. In a recent report they warned that central banks have encouraged companies to pursue “financial risk-taking” and gorging on debt. “Corporate leverage can also amplify shocks, as corporate deleveraging could lead to depressed investment and higher unemployment, and corporate defaults could trigger losses and curb lending by banks,” the IMF wrote.

According to the IMF, a downturn only half as bad as 2008 would put $19 trillion of debt—nearly 40% of the corporate borrowing in major countries—at risk of default. The economic consequences would be horrific.

Corporate debt has doubled in the decade since the financial crisis, non-financial companies now owe a record $9.6 trillion in the United States. Globally, companies have issued $13 trillion in bonds. Much of the debt is Chinese, and their companies will struggle to repay any of it given the lockdown and the breakdown in supply chains.

We have not even begun to see the full extent of the corporate bond market meltdown. One little discussed problem is that a large proportion of the debt is “junk”, i.e. lowly rated. An astonishing $3.6 trillion in bonds are rated “BBB”, which is only one rating above junk. These borderline bonds account for 54% of investment-grade corporate bonds, up from 30% in 2008. When recessions happen, these will be downgraded and fall into junk category. Many funds that cannot own junk bonds will become forced sellers. We will see an absolute carnage of forced selling when the downgrades happen. Again, the illusion of safety and liquidity will be exposed by the coronavirus.

—

The average family is encouraged to save money for a rainy day, in case they are fired, or they face hardship. Saving some money is considered prudent. It’s quite different for business. Companies pocket the profits in the good years and ask Uncle Sam to bail them out in the bad years. Heads shareholders win, tails the taxpayer loses.

Industry can’t be blamed for not expecting an act of God or force majeure, but in the past 30 years we have seen two Gulf Wars, 9/11, SARS, MERS, Swine Flu, the Great Financial Crisis, etc. Saving for a rainy day should only be expected in cyclically sensitive industries.

But rather than do that, companies have been engaging in a rather more reckless strategy: borrowing to buyback shares. This may boost their Return on Equity (ROE), but it is not remotely prudent and makes their companies highly vulnerable. Borrowing to prop up their own shares means they have less on hand when hard times come.

According to Barons, “Stock buybacks within the S&P 500 index totaled an estimated $729 billion in 2019, down from a record $806 billion in 2018.”

And then along came coronavirus.

Of those industries that are now seeking a bailout, none has saved for a rainy day. Boeing, the poster boy of financial engineering and little real engineering, bought back over $100 billion worth of stock over the past few years. Today it is asking the government for a backstop to its borrowing.

According to Bloomberg, since 2010, the big US airlines have spent 96% of their free cash flow on stock buybacks. Today, they’re asking US taxpayers for $25 billion.

Airline CEOs have been handsomely paid while not saving for a rainy day. Delta Airline’s CEO Ed Bastian made the most, earning nearly $15 million in total compensation. American CEO Doug Parker $12 million, while United CEO Oscar Munoz earned total compensation last year of $10.5 million.

Corporate buyback culture is financial engineering not value creation

The cruise liners were little different. Over the past decade, Carnival Cruises paid $9.2 billion dollars in dividends to its billionaire owners and bought back $6.7 billion of shares. Royal Caribbean, which is a smaller company, paid out $2.7 billion in dividends and $1.6 billion in buybacks. And the smallest cruise liner Norwegian Cruise Line spent $1.3 billion on share buybacks.

For years, the cruise lines have triumphally proclaimed massive dividends and buybacks. For example, Carnival proudly announced in 2018. “In just three years, we have doubled our quarterly dividend and invested $3.5 billion in Carnival stock.”

Cruise lines have no real claim to any bailout. They pay no taxes due to a legal loophole, and all their vessels fly the flags of Liberia, Panama and the Marshall Islands. Furthermore, their owners tend to be billionaires with more than enough financial wherewithal to recapitalise their own businesses. Their shareholders are not among the 1%. They’re among the 0.01% of richest people in the world. In the worst-case scenario, the US has a highly efficient bankruptcy process. Bondholders of today become shareholders of tomorrow, and the companies can have a fresh start. Bondholders would only be more than happy to own the equity of these companies.

Banks, too, will inevitably be asking for bailouts before this is over. Banks have among the most aggressive stock buyback programs of any industry, with some repurchasing a staggering 10% of their outstanding shares annually. The eight biggest banks have announced they will suspend their share buybacks for the next two quarters due to the COVID-19 pandemic on the global economy. In 2019, the top eight banks bought back $108 billion of their own stock.

If any good can come of the current crisis, perhaps it is exposing the irresponsibility of share buybacks and lack of prudence of most companies.

—

Monetary policy was one of the mechanisms employed in response to the last crisis, in the hope its effects would trickle down to the unwashed masses. Central banks bought vast amounts of treasuries and mortgage bonds to tighten financial spreads for banks and borrowers, but none of it went directly to households. It was all intermediated by the financial system and those who had access to capital.

The absurdity of the policy was perfectly illustrated recently in Europe. The European Central Bank has been busy buying bonds, and recently it bought bonds from LVMH, the luxury conglomerate owned by the world’s richest man Bernard Jean Étienne Arnault. The bonds had a negative yield, meaning that the ECB was paying LVMH to borrow. LVMH used the ECBs money to buy Tiffany.

If rates are now so low that billionaires are being paid to borrow, monetary policy has reached the limits of its usefulness.

Investors own stocks because their bond portfolios have acted like a hedge. Whenever stocks have fallen, bonds have gone up. In every downturn since the 1980s, central banks have cut rates, but most government bonds now have close to zero yields.

Extremely low interest rates and high valuations mean that any small change in interest rates will make portfolios much more volatile. If interest rates were to rise even slightly, they would vaporise many bond and stock portfolios. The margin of safety in bonds and stocks has diminished rapidly as rates have approached zero.

The world is now upside down. Many investors now buy stocks for current income and buy bonds to trade given how volatile they have become. Things cannot hold.

—

What do high frequency market making, share buybacks and high corporate debt have in common? They are supposedly tools to make trading, growth and returns on capital more efficient and cheaper, yet they have made the system more fragile and less resilient. Perhaps returns on capital and cheapness of market orders and ETFs are less important than stability and anti-fragility, i.e. designing systems that are robust in the face of stress.

We have seen the fragility in supply chains in the recent crisis.When the coronavirus struck in China, suddenly companies everywhere found out that outsourcing all their manufacturing and even medicines and face masks to China might be a problem.

Manufacturing has become less robust, more fragile, even if the returns on capital are better for those companies that outsource everything to China in pursuit of share buybacks.

The lessons of history are instructive. Although planting a single, genetically uniform crop might be more efficient and increase yields in the short run, low genetic diversity increases the risk of losing it all if a new pest is introduced or rainfall levels drop.

Have we been played by China?

The Irish Potato Famine is one such cautionary tale of the danger of monocultures, or only growing one crop. The potato first arrived in Ireland in 1588, and by the 1800s, the Irish had used it to solve the problem of feeding a growing population. They planted the “lumper” potato variety. All of these potatoes were genetically identical to one another, and it was vulnerable to the pathogen Phytophthora infestans. Because Ireland was so dependent on the potato, one in eight Irish people died of starvation in three years during the Irish potato famine of the 1840s.

The lessons from nature are dire. In the 1920s, the Gros Michel banana was almost wiped out by a fungus known as Fusarium cubense, and banana shortages became a growing problem. The widespread planting of a single corn variety contributed to the loss of over a billion dollars worth of corn in 1970, when a fungus hit the US crop. In the 1980s, dependence upon a single type of grapevine root forced California grape growers to replant approximately two million acres of vines when the pest phylloxera attacked.

Today, China is manufacturing’s monoculture.

—

Against this dangerous backdrop of volatility and uncertainty, the coronavirus will now achieve the impossible. For the past few years, two ideas have floated around on the political fringes of the Left, but they have been dead on arrival. No one has seriously thought they might become government policy. Today, the Left and Right in the United States and Europe are embracing them.

Andrew Yang, a former tech executive from New York, ran a quixotic, obscure presidential campaign in the United States based on the idea that every citizen should receive a Universal Basic Income (UBI). He advocated a “Freedom Dividend”. This would be a form of universal basic income that would provide a monthly stipend of $1,000 for all Americans between the ages of 18 and 64.

Today, Trump, Pelosi, Romney and others are fully backing Yang’s idea. Respected think tanks such Brookings and Chatham House have advocated UBI. But once it is implemented, there will be no going back. Handouts will start small and grow.

The other big idea has come from Stephanie Kelton, who advised Bernie Sanders and advocates for Modern Monetary Theory (MMT). Kelton argues that in any country with its own currency, budget deficits don’t matter unless they cause inflation. The government can pay for what it needs by simply printing more money — no reason to borrow by issuing bonds. Helicopter money.

Could free cash fix the economy?

Her ideas were widely criticised across the Left and Right, ranging from Paul Krugman to Warren Buffett to Federal Reserve Chairman Jay Powell.

Yet today, the two ideas have come together. There are no atheists in foxholes. Even libertarians on Twitter are now calling for government intervention. Investors and politicians of all stripes are calling for UBI financed by MMT money issuing.

This is an epochal turning point, a great reset. The coronavirus is the grain of sand that will cause the avalanche.

For once the taboo of printing money to pay citizens is broken, we can never go back. Governments will spend money with few constraints, aided by central banks. It’s a strategy that has not worked well in emerging markets, and it did not work well in the 1970s — which has conveniently been forgotten.

Undoubtedly, the government must compensate citizens from mandatory curfews and quarantines. The short-term impacts of the lockdowns must be mitigated, but temporary policies must not become permanent political expedients.

That’s why the danger is not today or even a year from now, it’s five to ten years away, when the crisis has past, along with the reason for UBI and monetary easing. What politican will be disciplined enough to stop spending? What central banker will raise rates when it is unpopular to do so?

Today we are reaping the whirlwind of the last financial crisis. Rather than pursue lower leverage, less debt and more robust institutions and more responsible corporate behaviour, investors and companies instead learned that they would be bailed out in a crisis.

Central banks became enamored of their own success as fire fighters, and they have busily been trying to put out fires by

- encouraging reckless behaviour,

- prizing low volatility above a robust financial system,

- viewing “risk management” as preferring no financial corrections ever.

They should accept that sometimes putting out every single fire creates greater conflagrations. They should be humbler about the extent and limits of their power.

It looks like they’re about to learn the hard way.

The Doctor Who Helped Defeat Smallpox Explains What’s Coming

Epidemiologist Larry Brilliant, who warned of pandemic in 2006, says we can beat the novel coronavirus—but first, we need lots more testing.

LARRY BRILLIANT SAYS he doesn’t have a crystal ball. But 14 years ago, Brilliant, the epidemiologist who helped eradicate smallpox, spoke to a TED audience and described what the next pandemic would look like. At the time, it sounded almost too horrible to take seriously. “A billion people would get sick,” he said. “As many as 165 million people would die. There would be a global recession and depression, and the cost to our economy of $1 to $3 trillion would be far worse for everyone than merely 100 million people dying, because so many more people would lose their jobs and their health care benefits, that the consequences are almost unthinkable.”

Now the unthinkable is here, and Brilliant, the Chairman of the board of Ending Pandemics, is sharing expertise with those on the front lines. We are a long way from 100 million deaths due to the novel coronavirus, but it has turned our world upside down. Brilliant is trying not to say “I told you so” too often. But he did tell us so, not only in talks and writings, but as the senior technical advisor for the pandemic horror film Contagion, now a top streaming selection for the homebound. Besides working with the World Health Organization in the effort to end smallpox, Brilliant, who is now 75, has fought flu, polio, and blindness; once led Google’s nonprofit wing, Google.org; co-founded the conferencing system the Well; and has traveled with the Grateful Dead.

We talked by phone on Tuesday. At the time, President Donald Trump’s response to the crisis had started to change from “no worries at all” to finally taking more significant steps to stem the pandemic. Brilliant lives in one of the six Bay Area counties where residents were ordered to shelter in place. When we began the conversation, he’d just gotten off the phone with someone he described as high government official, who asked Brilliant “How the fuck did we get here?” I wanted to hear how we’ll get out of here. The conversation has been edited and condensed.

Steven Levy: I was in the room in 2006 when you gave that TED talk. Your wish was “Help Me Stop Pandemics.” You didn’t get your wish, did you?

Larry Brilliant: No, I didn’t get that wish at all, although the systems that I asked for have certainly been created and are being used. It’s very funny because we did a movie, Contagion—

We’re all watching that movie now.

People say Contagion is prescient. We just saw the science. The whole epidemiological community has been warning everybody for the past 10 or 15 years that it wasn’t a question of whether we were going to have a pandemic like this. It was simply when. It’s really hard to get people to listen. I mean, Trump pushed out the admiral on the National Security Council, who was the only person at that level who’s responsible for pandemic defense. With him went his entire downline of employees and staff and relationships. And then Trump removed the [early warning] funding for countries around the world.

I’ve heard you talk about the significance that this is a “novel” virus.

It doesn’t mean a fictitious virus. It’s not like a novel or a novella.

Too bad.

It means it’s new. That there is no human being in the world that has immunity as a result of having had it before. That means it’s capable of infecting 7.8 billion of our brothers and sisters.

Since it’s novel, we’re still learning about it. Do you believe that if someone gets it and recovers, that person thereafter has immunity?

So I don’t see anything in this virus, even though it’s novel, [that contradicts that]. There are cases where people think that they’ve gotten it again, [but] that’s more likely to be a test failure than it is an actual reinfection. But there’s going to be tens of millions of us or hundreds of millions of us or more who will get this virus before it’s all over, and with large numbers like that, almost anything where you ask “Does this happen?” can happen. That doesn’t mean that it is of public health or epidemiological importance.

Is this the worst outbreak you’ve ever seen?

It’s the most dangerous pandemic in our lifetime.

We are being asked to do things, certainly, that never happened in my lifetime—stay in the house, stay 6 feet away from other people, don’t go to group gatherings. Are we getting the right advice?

Well, as you reach me, I’m pretending that I’m in a meditation retreat, but I’m actually being semi-quarantined in Marin County. Yes, this is very good advice. But did we get good advice from the president of the United States for the first 12 weeks? No. All we got were lies. Saying it’s fake, by saying this is a Democratic hoax. There are still people today who believe that, to their detriment. Speaking as a public health person, this is the most irresponsible act of an elected official that I’ve ever witnessed in my lifetime. But what you’re hearing now [to self-isolate, close schools, cancel events] is right. Is it going to protect us completely? Is it going to make the world safe forever? No. It’s a great thing because we want to spread out the disease over time.

Flatten the curve.

By slowing it down or flattening it, we’re not going to decrease the total number of cases, we’re going to postpone many cases, until we get a vaccine—which we will, because there’s nothing in the virology of this vaccine that makes me frightened that we won’t get a vaccine in 12 to 18 months. Eventually, we will get to the epidemiologist gold ring.

What’s that?

That means, A, a large enough quantity of us have caught the disease and become immune. And B, we have a vaccine. The combination of A plus B is enough to create herd immunity, which is around 70 or 80 percent.

I hold out hope that we get an antiviral for Covid-19 that is curative, but in addition is prophylactic. It’s certainly unproven and it’s certainly controversial, and certainly a lot of people are not going to agree with me. But I offer as evidence two papers in 2005, one in Nature and one in Science. They both did mathematical modeling with influenza, to see whether saturation with just Tamiflu of an area around a case of influenza could stop the outbreak. And in both cases, it worked. I also offer as evidence the fact that at one point we thought HIV/AIDS was incurable and a death sentence. Then, some wonderful scientists discovered antiviral drugs, and we’ve learned that some of those drugs can be given prior to exposure and prevent the disease. Because of the intense interest in getting [Covid-19] conquered, we will put the scientific clout and money and resources behind finding antivirals that have prophylactic or preventive characteristics that can be used in addition to [vaccines].

When will we be able to leave the house and go back to work?

I have a very good retrospect-oscope, but what’s needed right now as a prospecto-scope. If this were a tennis match, I would say advantage virus right now. But there’s really good news from South Korea—they had less than 100 cases today. China had more cases imported than it had from continuous transmission from Wuhan today. The Chinese model will be very hard for us to follow. We’re not going to be locking people up in their apartments, boarding them up. But the South Korea model is one that we could follow. Unfortunately, it requires doing the proportionate number of tests that they did—they did well over a quarter of a million tests. In fact, by the time South Korea had done 200,000 tests, we had probably done less than 1,000.

Now that we’ve missed the opportunity for early testing, is it too late for testing to make a difference?

Absolutely not. Tests would make a measurable difference. We should be doing a stochastic process random probability sample of the country to find out where the hell the virus really is. Because we don’t know. Maybe Mississippi is reporting no cases because it’s not looking. How would they know? Zimbabwe reports zero cases because they don’t have testing capability, not because they don’t have the virus. We need something that looks like a home pregnancy test, that you can do at home.

If you were the president for one day, what would you say in the daily briefing?

I would begin the press conference by saying “Ladies and gentlemen, let me introduce you to Ron Klain—he was the Ebola czar [under President Barack Obama], and now I’ve called him back and made him Covid czar. Everything will be centralized under one person who has the respect of both the public health community and the political community.” We’re a divided country right now. Right now, Tony Fauci [head of the National Institute of Allergy and Infectious Diseases] is the closest that we come to that.

Are you scared?

I’m in the age group that has a one in seven mortality rate if I get it. If you’re not worried, you’re not paying attention. But I’m not scared. I firmly believe that the steps that we’re taking will extend the time that it takes for the virus to make the rounds. I think that, in turn, will increase the likelihood that we will have a vaccine or we will have a prophylactic antiviral in time to cut off, reduce, or truncate the spread. Everybody needs to remember: This is not a zombie apocalypse. It’s not a mass extinction event.

Should we be wearing masks?

The N95 mask itself is extremely wonderful. The pores in the mask are three microns wide. The virus is one micron wide. So you get people who say, well, it’s not going to work. But you try having three big, huge football players who are rushing for lunch through a door at lunchtime—they’re not going to get through. In the latest data I saw, the mask provided 5x protection. That’s really good. But we have to keep the hospitals going and we have to keep the health professionals able to come to work and be safe. So masks should go where they’re needed the most: in taking care of patients.

How will we know when we’re through this?

The world is not going to begin to look normal until three things have happened. One, we figure out whether the distribution of this virus looks like an iceberg, which is one-seventh above the water, or a pyramid, where we see everything. If we’re only seeing right now one-seventh of the actual disease because we’re not testing enough, and we’re just blind to it, then we’re in a world of hurt. Two, we have a treatment that works, a vaccine or antiviral. And three, maybe most important, we begin to see large numbers of people—in particular nurses, home health care providers, doctors, policemen, firemen, and teachers who have had the disease—are immune, and we have tested them to know that they are not infectious any longer. And we have a system that identifies them, either a concert wristband or a card with their photograph and some kind of a stamp on it. Then we can be comfortable sending our children back to school, because we know the teacher is not infectious.

And instead of saying “No, you can’t visit anybody in nursing home,” we have a group of people who are certified that they work with elderly and vulnerable people, and nurses who can go back into the hospitals and dentists who can open your mouth and look in your mouth and not be giving you the virus. When those three things happen, that’s when normalcy will return.

Is there in any way a brighter side to this?

Well, I’m a scientist, but I’m also a person of faith. And I can’t ever look at something without asking the question of isn’t there a higher power that in some way will help us to be the best version of ourselves that we could be? I thought we would see the equivalent of empty streets in the civic arena, but the amount of civic engagement is greater than I’ve ever seen. But I’m seeing young kids, millennials, who are volunteering to go take groceries to people who are homebound, elderly. I’m seeing an incredible influx of nurses, heroic nurses, who are coming and working many more hours than they worked before, doctors who fearlessly go into the hospital to work. I’ve never seen the kind of volunteerism I’m seeing.

I don’t want to pretend that this is an exercise worth going through in order to get to that state. This is a really unprecedented and difficult time that will test us. When we do get through it, maybe like the Second World War, it will cause us to reexamine what has caused the fractional division we have in this country. The virus is an equal opportunity infector. And it’s probably the way we would be better if we saw ourselves that way, which is much more alike than different.

The psychological reasons why Gen X may be taking COVID-19 more seriously than boomers and millennials

It appears some millennials and seniors haven’t been as worried about their risk of contracting COVID-19: Over the weekend, many young people continued to go to bars and restaurants despite urging from public officials to social distance. Others struggled to convince older parents and relatives that COVID-19 is, in fact, a big deal. And a Harris poll on 2,000 adults published March 13 found 77% of adults over 65 and 67% of millennials (those born between 1981 and 1996) said they’re “unlikely” to catch the virus, which has infected at least 189,000 people around the globe.

So, who is taking COVID-19 seriously? Possibly Gen X, who are born between 1965 and 1980 according to Pew Research Center, and are often referred to as the “sandwich generation” because many are caring for children and older parents. On social media this weekend, the hashtag “GenX” trended, with the “latchkey generation” saying that they were the most prepared to live in isolation.

From a psychological perspective, there might be some truth to this argument.

“Every generation will react differently [to COVID-19] based on the experiences that generation has had,” Paul Gionfriddo, president and CEO of the nonprofit Mental Health America tells CNBC Make It.

One theory is that Gen X might have more experience working through tumultuous times, as they were in the workforce during other pivotal times like 9/11 and the 2008 stock market crash.

And amid the COVID-19 pandemic, many Gen X-ers who are responsible for running households, taking care of children and caring for elderly parents must assume the brunt of stress.

“The sandwich generation is concerned about parents and children, and they are also the working generation that is concerned about how they’re going to pay the bills next month,” Gionfriddo says. In other words, they don’t have a choice but to take COVID-19 more seriously.

Older generations, such as baby boomers (those born between 1946 and 1964) and older, may have a greater set of experiences, but their attention is likely going to be turned to worrying about children and grandchildren than their own health, Gionfriddo says.

While those over 65 technically have the highest risk of getting seriously ill from COVID-19, “your parents are going to feel that they are still capable of taking care of themselves,” David Nace, chief medical officer of UPMC Senior Communities, tells CNBC Make It. That’s at least in part because this may be the first time they’re considered part of the “older” or “at-risk” population, which can be jarring.

Younger generations such as millennials and Gen Z have their own reasons for responding in a way that some might consider nonchalant.

For one thing, these younger generations tend to “stare down” problems, which is a coping or survival mechanism, Gionfriddo says. For example, many young people continued to go to bars and restaurants, despite warnings to socially isolate to stop the spread of COVID-19.

“They just say, ‘I’m going to face down death, because I see it so much less,’” he says.

And studies suggest that millennials are actually more stressed than other generations, which is why they’re often referred to as “the worry generation.” A 2018 survey from the American Psychological Association found that Gen Z adults are most likely of all generations to report poor mental health.

“When you tack on something like [COVID-19], you’re basically not going to see as dramatic a change in their outlook, because the generation is already so stressed,” Gionfriddo says.

Regardless of your age, it’s important that “everyone understands more than ever that these threats are real,” Gionfriddo says. To that end, you should take your fears and anxieties seriously, Gionfriddo says.

“Don’t be shamed into thinking that it’s not okay to feel worried,” he says.

Chloroquine May Fight Covid-19—and Silicon Valley’s Into It

The old malaria drug is getting used against the coronavirus. Tech enthusiasts are abuzz. One missing step: clinical trials.

THE CHATTER ABOUT a promising drug to fight Covid-19 started, as chatter often does (but science does not), on Twitter. A blockchain investor named James Todaro tweeted that an 85-year-old malaria drug called chloroquine was a potential treatment and preventative against the disease caused by the new coronavirus. Todaro linked to a Google doc he’d cowritten, explaining the idea.

Though nearly a dozen drugs to treat coronavirus are in clinical trials in China, just one—remdesivir, an antiviral that was in trials against Ebola and the coronavirus MERS—is in full-on trials in the US. Nothing has been approved by the Food and Drug Administration. So a promising drug would be great—and even better, chloroquine isn’t new. Its use dates back to World War II, and it’s derived from the bark of the chinchona tree, like quinine, a centuries-old antimalarial. That means the drug is now generic and is relatively cheap. Physicians understand it well, and they’re allowed to prescribe it for anything they want, not just malaria.

Todaro’s tweet got thousands of likes. The engineer/tech world picked up the idea. The widely-read blog Stratechery linked to Todaro’s Google document; Ben Thompson, the blog’s editor, wrote that he was “wholly unqualified to comment” but that the anecdotal evidence favored the idea. Echoing the document, Thompson wrote that the paper was written in consultation with Stanford Medical School, the University of Alabama at Birmingham medical school, and National Academy of Sciences researchers—none of which is exactly true. (More on that in a bit.) One of Todaro’s coauthors, a lawyer named Gregory Rigano, went on Fox News to talk about the concept. Tesla and SpaceX CEO Elon Musk tweeted about it, citing an explanatory YouTube video from a physician who’s been doing a series of coronavirus explainers. To be fair, Musk wasn’t all-in on the idea absent more data, though he wrote that he’d received a life-saving dose of chloroquine for malaria.

It’s the definition of “big if true.” Part of the story of Covid-19, of the coronavirus SARS-CoV-2, is that it is novel. Humans don’t have any immunity to it. There’s no vaccine, no drug approved to treat it. But if a drug did exist—if a cheap, easy drug can stave off the worst, ventilator-requiring, sometimes-fatal complications of coronavirus infection, or maybe prevent that infection in the first place, what are we all socially isolating for, like suckers?

That if—as the saying goes—is doing a lot of work. The Covid-19 pandemic is causing, reasonably, a worldwide freak-out as scientists and policymakers race to find solutions, not always competently or efficiently. It’s the kind of thing that rankles the engineer-disruptor mindset. Surely this must be an easily solved problem that’s primarily the fault of bureaucracy, regulation, and people who don’t understand science. And maybe the first two things are true. The third thing, though, is where the risks hide. Silicon Valley lionizes people who rush toward solutions and ignore problems; science is designed to find solutions by identifying those problems. The two approaches are often incompatible.

What happened here, specifically, is that Rigano sought Todaro out. Todaro’s tweet identified Rigano as being affiliated with Johns Hopkins; Rigano’s LinkedIn profile says he’s on leave from a masters degree program there in bioinformatics, and has been an advisor to a program at Stanford called SPARK, which does translational drug discovery—finding new uses and applications for approved drugs. “I have a very unique background at the crossroads of law and science,” Rigano tells me. “I have been working with large pharmaceutical companies, universities, biotechs, and nonprofits in the development of drugs and medical products.” He says those contacts told him about the use of chloroquine against Covid-19 in China and South Korea, so he started reading up on it.

(Johns Hopkins did not return a request for comment; a spokesperson for Stanford Medical School emails: “Stanford Medicine, including SPARK, wasn’t involved in the creation of the Google document, and we’ve requested that the author remove all references to us. In addition, Gregory Rigano is not an advisor with Stanford School of Medicine and no one at Stanford was involved in the study.“)

It turns out that people have been pitching chloroquine as an antiviral for years. In the early 1990s researchers proposed it as an adjunct to early protease inhibitor drugs to help treat HIV/AIDS. A team led by Stuart Nichol, the head of the Special Pathogens Unit at the Centers for Disease Control and Prevention, published a paper in 2005 saying that the drug was effective against primate cells infected with SARS, the first big respiratory coronavirus to affect humans. That’s an in vitro test, not live animals—just cells.

Nichol didn’t respond to a request for comment, but a CDC spokesperson emailed this: “CDC is aware of reports of various medications being administered for either treatment or prophylaxis for COVID-19, including those demonstrating in vitro activity against SARS-CoV- 2. At this time, it is important to ensure robust clinical data, gathered from clinical trials, are obtained quickly in order to make informed clinical decisions regarding the management of patients with COVID-19.”

At a World Health Organization press conference in February, a reporter from the fact-checking group Africa Check asked whether chloroquine was an option. Janet Diaz, head of clinical care for the World Health Organization Emergencies Program, answered that WHO was prioritizing a couple of other drugs in testing along with remdesivir, and acknowledged that Chinese researchers were working on even more. “For chloroquine, there is no proof that that is an effective treatment at this time,” Diaz said. “We recommend that therapeutics be tested under ethically approved clinical trials to show efficacy and safety.”

Chloroquine and an alternative version called hydroxychloroquine seem to work on viruses by inhibiting a process called glycosylation, a chemical transformation of the proteins in the virus’s outer shell that’s part of the infection process. Chinese researchers have initiated perhaps a half-dozen randomized trials of the two versions in humans and gotten at least some promising initial data.

With that data in mind, a French infectious disease researcher named Didier Raoult published a fast review of existing in vitro studies of chloroquine and hydroxychloroquine, and (along with some other researchers) has recommended not only spinning up research in humans but also starting to use the drugs clinically. (Raoult didn’t return a request for comment, but a publicist at the hospital where he works sent a link to a video in which Raoult presents data he says shows efficacy in a small group of actual humans. That data hasn’t been published or peer reviewed.)

Except for that video, which hadn’t come out yet, Rigano put all that together and got in touch with Todaro. “I essentially wrote the publication based on my interface with various Stanford researchers and others, and we developed this body of evidence and hardcore science,” Rigano says. “James, Dr. Todaro, was doing the best job, I thought, of anyone in the media, any doctor, any news outlet, anyone on Twitter, of covering coronavirus. I’d been following his research on other items, like decentralized computing, for several years.”

Todaro, who got an MD from Columbia and is now a bitcoin investor, was interested enough to collaborate on the document. “I added stuff that pertained more to the medical side of things, and gave a more, I guess, clinical feel to it,” Todaro says. “Something that Big Pharma is not going to like—it’s widely available, it’s pretty cheap, and it’s something that at least a million people are already on. It’s really got a lot of the aspects of something that can be rolled out quickly if the right clinical data is there.”

Todaro and Rigano together started talking to Raoult about the small study he was then preparing, and they also called a retired biochemist named Tom Broker. He was originally listed as the first author of the Google doc, his name followed by “(Stanford).” That’s where Broker got his PhD, in 1972, but Broker has been, for years, at the University of Alabama at Birmingham. His area of research is adenovirus and human papillomavirus, which have DNA as their genetic material, as opposed to the RNA inside coronaviruses. They’re pretty different.

Broker says he wasn’t involved in producing the Google doc and would never advocate the use of a drug without formal trials. Todaro and Rigano have since removed his name from it, at Broker’s request. “I neither contributed to, wrote any part of, nor had knowledge of this google.com document. I have never conducted research on RNA virus pathogens … I have no professional credentials or authority to suggest or recommend clinical trials or practices,” Broker wrote in an email. “Apparently I was inserted as a ‘gratuitous’ author, a practice that I have always avoided over my 53-year career. Moreover, I have never engaged any part of social media, privately or professionally. All of my scientific publications are processed through peer review. I suggest that you communicate with one of the actual authors.”

Asked about Broker’s statement, Todaro says that Broker just didn’t want to engage with the attention the idea and document were getting “I don’t personally know Tom Broker. My correspondence has been with Mr. Rigano,” Todaro says. “When we started getting inquiries from the press, my impression was, Mr. Broker got very overwhelmed by that.”

Rigano says that was his impression as well. “Dr. Broker is a scientist of the highest order. He’s not used to this type of media attention, so we kind of just have to proceed without him here,” Rigano says. “He’s not ready for the media, becoming a celebrity.”

The chloroquine document Todaro and Rigano wrote spread almost—sorry about this—virally. But even though some people are hyping this is a treatment, it still has not yet undergone a large-scale randomized control trial, the gold standard for evaluating whether a medical intervention like a drug actually works. Until that happens, most physicians and researchers would say that chloroquine can’t be any kind of magic bullet. “Many drugs, including chloroquine or hydroxychloroquine, work in cells in the lab against coronaviruses. Few drugs have been shown to work in an animal model,” says Matthew Frieman, a microbiologist who studies therapeutics against coronaviruses at the University of Maryland. What happens if you put the drugs into animals? No one knows yet. Probably nothing bad, because they’ve been used for decades. But maybe they don’t actually help a person fight off the virus.

Chloraquine’s action, Frieman says, “has been known for some time for other coronaviruses but never developed as a tested therapeutic in humans. There is reason to believe that will change now, along with other therapeutics that have efficacy in the lab.” That’s because the new coronavirus is encouraging research to pick up again on just about anything that has ever shown any effect on coronaviruses, and some new ideas too.

Rigano says he and Todaro are now spinning up their own clinical trials, though it isn’t clear how they intend to collect or present the data. They’re hoping to have clinicians enroll as subjects, and they’d then prescribe hydroxychloroquine to themselves as they treat patients with Covid-19. When asked what the control group would be—case-matched physicians who didn’t take the drug, perhaps?—Rigano had a couple of ideas. “You can use historical controls, the rate of medical doctors being infected that were not on hydroxychloroquine regularly. And if there are doctors that would like to participate in the study that would like to not take hydroxychloroquine, they would also be excellent controls,” Rigano says. “Ethically speaking, we don’t want anyone to contract this virus. It’s really a wonderful design.”

Rigano says he’s talking to staff at four Australian hospitals about spinning up a bigger, randomized trial after the one with volunteer physicians is underway.

Rigano and Todaro know that a Google doc shared over Twitter isn’t the way science typically gets done. But they say there’s no time to waste, that the pandemic is moving too fast for traditional science. “That would take months,” Todaro says. “I’d hate to bank on things we would find in months, or a vaccine that comes out in mid to late 2021.”

They’re not the only ones with those worries, of course. The latest model from Imperial College London of Covid-19’s progress lays out a worst worst-case scenario that involves millions of deaths, or social distancing and sheltering in place across the planet for more than a year. Social distance might give hospitals a better chance to accommodate and treat the sick, but unsheltering means the disease just comes back. The only things that would shift those outcomes are vaccines or drugs.

Chloroquine and hydroxychloroquine aren’t the only candidates. There’s a protease inhibitor called camostat mesylate that a team of German scientists says works against the mechanism that SARS-CoV-2 uses to attach to the cells it infects. Virologists are pitching nucleoside analog inhibitors—remdesivir is one of these—that screw up the virus’ ability to replicate its RNA. Trials are actually going on—in China—on drugs like darunavir and cobicistat and interferon. And that doesn’t even get into the world of monoclonal antibodies that amp up a person’s own immune system to fight the virus. It’s good that all these things are in the works, and chloroquine’s relatively easy access does make it attractive … but no one knows which of these things is going to help people with Covid-19. All of them have side effects, to greater or lesser extents. Even chloroquine, well known and well tolerated, can cause nausea, heart palpitations, and—at the most extreme—eye damage and hallucinations.

Here’s the even deeper irony: Physicians are already using chloroquine anyway, because there’s nothing else yet. President Donald Trump actually mentioned it in a press conference on Thursday, praising the fact that it’s already approved by the FDA, albeit, again, not specifically for Covid-19. “It’s show—encouraging, very, very encouraging early results,” Trump said. “And we’re going to be able to make that drug available almost immediately.”

Not only is it already available, as it has been for almost a century, but Covid-19 patients are already getting it. Montefiore Medical Center in New York has already started seeing the surge of Covid-19 patients that public health experts have been warning about. The hospital is participating in the remdesivir trial and is giving Covid-19 patients chloroquine. “All of our patients get put on chloroquine, as well as on antiretrovirals. We’re using Kaletra. Different places are using different antiretrovirals,” says Liise-anne Pirofski, chief of infectious diseases at Albert Einstein College of Medicine and Montefiore. “Everybody gets that, unless they have some contraindication.”

And, according to Axios, the pharmaceutical company Bayer is getting ready to donate some large amount of the drug to the US—unclear what agency, though Axios cites an anonymous source at the Department of Health and Human Services—for use against Covid-19.

So it’s entirely possible that the disruptors are right about chloroquine, but wrong about how to prove it. Right now, in the midst of a crisis, they’re on the same page as the front-line practitioners facing a tsunami of sick people and nowhere near enough ventilators to keep them all breathing. Chloroquine has a chance of helping; the doctors are hoping it’ll do no harm.