What is the US Debt Endgame? (Google AI Answers)

Economies run in cycles, both short and long-term.

With Debt levels running high, how will the long-term debt cycle be resolved? 1

I asked Google Bard’s AI 2 what it thought of 6 possible options I outlined for resolving high debt levels.

Upon receiving AI’s answers, I was reminded of a quote (incorrectly) ascribed to Winston Churchill:

Americans can always be counted on to do the right thing .. after they have exhausted all other possibilities.

My base case estimate is a twist on this quote. It is not that America will attempt all other possibilities before finally settling on the “right thing,” but rather the resolution of high debt levels3 will likely involve pursuing nearly all available options together. These options will not all be undertaken simultaneously, but all options will be attempted (except #5) before the cycle is resolved.

Here are the 6 options I presented to AI:

- “Debt Jubilee”

- Adoption of a hard money

- MMT : Modern Monetary Theory

- “Soft Default”

- “Hard default”

- Transition to a new system

Google Bard’s AI suggested another 4 other options:

Google Bard AI Answers:

Below are my questions to Google Bard’s AI and its responses:

I’m going to outline 6 possible outcomes to high US debt levels.

After I’m done giving you the 6th potential outcome, please suggest other possible outcomes ..

Please go ahead and outline the 6 possible outcomes to high US debt levels. I will try my best to suggest other possible outcomes after you have finished.

Note: I am still under development, and I may not be able to suggest all possible outcomes. However, I will do my best to provide a comprehensive and informative response.

1) The debt will be forgiven. This is sometimes called a “Year of Jubilee”. This idea originated with the Babylonians and was adopted by the nation of Israel. This outcome is necessary because money compounds and if debts are not forgiven they spiral out of control .. #

Yes, debt forgiveness is a possible outcome to high US debt levels. It is important to note that debt forgiveness would have a significant impact on both the US economy and the global economy.

On the one hand, debt forgiveness could stimulate economic growth by freeing up individuals and businesses to spend and invest more money. It could also reduce the risk of a financial crisis by making it less likely that borrowers will default on their loans.

On the other hand, debt forgiveness could also lead to inflation, as the government would likely need to print money to pay off its debt.4 It could also reduce the willingness of lenders to lend money in the future, as they would be more concerned about the risk of default.5

Overall, the decision of whether or not to forgive US debt would be a complex one with both positive and negative consequences.

Here are some other possible outcomes of high US debt levels:

- Higher interest rates: As the US government borrows more money, it will have to compete with businesses and individuals for loans. This could lead to higher interest rates for everyone.

- Slower economic growth: High debt levels can make it difficult for businesses to invest and grow. This could lead to slower economic growth and fewer jobs.

- Inflation: If the US government prints money to pay off its debt, it could lead to inflation. This means that the value of the dollar would decrease, and prices would go up.

- Financial crisis: If the US government defaults on its debt, it could lead to a financial crisis. This would have a devastating impact on the US economy and the global economy.

It is important to note that these are just some of the possible outcomes of high US debt levels. The actual outcome will depend on a number of factors, including the policies of the US government and the reaction of global markets.

2) The US could discontinue the fiat dollar and instead adopt a “hard money” like gold, silver, or bitcoin as a way to constrain the government, preventing it from “debasing” the money .. #

Yes, the US could discontinue the fiat dollar and adopt a hard money like gold, silver, or bitcoin as a way to constrain the government, preventing it from “debasing” the money.

Debasement is the process of reducing the value of a currency. This can be done by printing more money, which reduces the purchasing power of each individual dollar. Debasement can also be done by reducing the amount of gold or silver backing a currency.

Hard money, on the other hand, is a currency that is backed by a physical commodity, such as gold or silver. This makes it difficult for the government to debase the currency, as it would need to have enough of the underlying commodity to back all of the money in circulation.

There are a number of potential benefits to adopting a hard money. First, it can help to constrain the government’s ability to spend money. This is because the government cannot simply print more money to finance its spending. Instead, it must have enough of the underlying commodity to back all of the money in circulation.

Second, hard money can help to reduce inflation. This is because the supply of hard money is limited by the availability of the underlying commodity. As a result, it is difficult for the government to debase the currency and cause inflation.

Third, hard money can help to increase economic stability. This is because hard money is less likely to be affected by financial crises. This is because hard money is backed by a physical commodity, which has intrinsic value.

However, there are also a number of potential drawbacks to adopting a hard money. First, it can lead to deflation. This is because the supply of hard money is limited by the availability of the underlying commodity. As a result, the value of hard money can tend to increase over time. This can make it difficult for businesses to borrow money and invest, which can lead to slower economic growth.

Second, hard money can make it difficult for the government to respond to economic downturns. This is because the government cannot simply print more money to stimulate the economy. Instead, it must have enough of the underlying commodity to back all of the money in circulation.

Third, hard money can be difficult to use and transport. This is because hard money is often heavy and bulky. As a result, it can be difficult to use for everyday transactions.

Overall, the decision of whether or not to adopt a hard money is a complex one with both positive and negative consequences.

Here are some other possible outcomes of the US discontinuing the fiat dollar and adopting a hard money:

- Increased volatility in the value of the currency: The value of a hard money can be more volatile than the value of a fiat currency. This is because the value of a hard money is determined by the supply and demand for the underlying commodity.

- Reduced economic growth: A hard money can make it more difficult for businesses to borrow money and invest. This is because the supply of hard money is limited by the availability of the underlying commodity.

- Increased social inequality: A hard money can benefit wealthy individuals and businesses, who are more likely to own the underlying commodity. This can lead to increased social inequality.

It is important to note that these are just some of the possible outcomes of the US discontinuing the fiat dollar and adopting a hard money. The actual outcome will depend on a number of factors, including the specific type of hard money that is adopted and the way in which it is implemented.

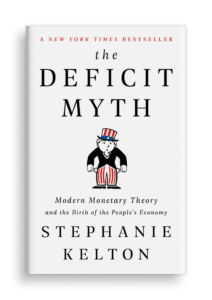

3) Modern monetary theory predicts that governments can run larger deficits and carry more debt than otherwise thought. Modern monetary economists such as Stephany Kelton say that economists should not focus so much on deficits and instead focus on inflation levels. MMT economists predict that higher debt levels should be more bearable than otherwise thought .. #

Modern monetary theory (MMT) is a macroeconomic theory that argues that governments can run larger deficits and carry more debt than otherwise thought, without fear of inflation or default, because they can issue fiat currency.

MMT economists argue that the government should focus on using its fiscal policy to achieve full employment and price stability, rather than worrying about budget deficits. They argue that government spending is not constrained by tax revenue, but by the availability of real resources, such as labor and capital.

MMT economists also argue that inflation is not caused by government deficits, but by the Federal Reserve printing too much money to buy government bonds. They argue that the Fed can use its monetary policy to control inflation, regardless of the size of the government deficit.

MMT economists predict that higher debt levels should be more bearable than otherwise thought. They argue that the government can always issue more money to service its debt, and that inflation is unlikely to occur as long as the economy is at full employment.

However, MMT is a controversial theory, and many mainstream economists disagree with its conclusions. Mainstream economists argue that large government deficits can lead to inflation and higher interest rates. They also argue that government spending is constrained by tax revenue, and that the government cannot simply print money to pay for its spending without causing inflation.

It is important to note that MMT is a relatively new theory, and it has not yet been fully tested in the real world. However, it is a growing theory, and it is gaining popularity among some policymakers.

Here are some of the potential benefits of MMT:

- Increased government spending can stimulate the economy.

- MMT can help to reduce unemployment.

- MMT can help to improve the standard of living for all citizens.

Here are some of the potential drawbacks of MMT:

- MMT can lead to inflation.

- MMT can reduce the value of the currency.

- MMT can make it more difficult for the government to borrow money in the future.

Overall, MMT is a complex theory with both potential benefits and drawbacks. More research is needed to fully understand the implications of MMT.

4) The government could achieve a “soft default” by causing higher levels of inflation, which causes the “real” value of the debt to be inflated away. Because the nominal value of GDP would go up while the nominal debt does not, the real value of the debt would be a smaller percentage of GDP .. #

Yes, the government could achieve a “soft default” by causing higher levels of inflation, which causes the “real” value of the debt to be inflated away. This is because inflation erodes the purchasing power of money, meaning that each dollar is worth less over time.

For example, if the government has a debt of $100 billion and the inflation rate is 5% per year, then the real value of the debt will decrease by 5% each year. This means that the government will be able to pay off its debt with less money in real terms.

Soft defaults are often used by governments that are struggling to repay their debts. However, they can also be used by governments that want to reduce the real value of their debt.

Here are some of the potential benefits of a soft default:

- The government can reduce the real burden of its debt.

- The government can free up resources to spend on other priorities.

- The government can stimulate the economy by increasing inflation.

However, there are also a number of potential drawbacks to a soft default:

- Soft defaults can erode the value of the currency.

- Soft defaults can hurt savers and creditors.

- Soft defaults can lead to higher interest rates.

- Soft defaults can damage the government’s reputation.

Overall, soft defaults are a complex issue with both potential benefits and drawbacks. Governments should carefully consider the pros and cons of a soft default before making a decision.

It is important to note that soft defaults are not always successful. If the government does not carefully manage inflation, it can lead to hyperinflation, which can be devastating for the economy.

In addition, soft defaults can damage the government’s reputation and make it more difficult to borrow money in the future.

5) Another option would be to arrange for a sudden and dramatic debasement of the currency. Prices could double overnight, making it easier to pay back debts with devalued currency .. #

Yes, another option for the US government would be to arrange for a sudden and dramatic debasement of the currency. This would make it easier to pay back debts with devalued currency, as the debts would be worth less in real terms after the debasement.

However, a sudden and dramatic debasement of the currency would have a number of negative consequences. First, it would erode the purchasing power of the US dollar and make it more difficult for Americans to buy goods and services. Second, it would lead to inflation, as businesses would pass on the higher cost of goods and services to consumers. Third, it would damage the US economy and make it more difficult for businesses to invest and grow. Fourth, it would damage the US government’s reputation and make it more difficult to borrow money in the future.

Overall, a sudden and dramatic debasement of the currency would be a very risky and costly way for the US government to pay back its debts. It is important to note that this option is rarely used by governments, as the negative consequences are often too severe.

Here are some of the potential benefits of a sudden and dramatic debasement of the currency:

- The government can reduce the real burden of its debt.

- The government can free up resources to spend on other priorities.

However, there are also a number of potential drawbacks to a sudden and dramatic debasement of the currency:

- It would erode the purchasing power of the US dollar.

- It would lead to inflation.

- It would damage the US economy.

- It would damage the US government’s reputation.

Overall, a sudden and dramatic debasement of the currency is a very risky and costly option for the US government. It should only be used as a last resort.

It is important to note that there is no easy solution to the problem of high US debt levels. The US government will need to carefully consider all of its options and choose the one that is least damaging to the economy.

6) A final option would be for the Federal Reserve to inflate the dollar, while people voluntarily transition to a new system, be that Bancor or Bitcoin, or something else.

The effect of a transition to a new system would be like the Babylonian option in that the debt would be forgiven, but the result would be a one-time event. It would not establish debt forgiveness as a regular tradition.

Another option would be to use different currencies for cash (medium of exchange) and savings (store of value). In this system the cash (US dollar) would be used for buying things (medium of exchange), but people would save their money in some other format (non-dollar bonds, Bancorp, gold, Bitcoin).

The reason why the US dollar might not be used for savings is because the US has so much debt and military entitlements spending and it is unwilling to reduce spending enough to avoid running large deficits.

Under this system, it would make sense to shift money to the savings “currency” and avoid keeping too much in the “cash” currency. This could mean diversifying savings beyond USD-denominated bonds and sources closely correlated with it. #

Yes, you have outlined some other potential outcomes of high US debt levels.

The Federal Reserve could inflate the dollar while people voluntarily transition to a new system. This would be a similar outcome to a “soft default,” but with the added benefit of people voluntarily choosing to switch to a new currency. This could help to avoid some of the negative consequences of a soft default, such as damage to the US government’s reputation.

People could start using different currencies for cash and savings. This is a common practice in many countries, and it can help to protect people’s savings from inflation. However, it is important to note that switching to a new currency for savings can be risky, as the value of the new currency could decline.

Overall, the best way to deal with high US debt levels is to reduce spending and increase taxes. However, if the US government is unable or unwilling to do this, then it may have to consider other options, such as those you have outlined.

It is important to note that all of these options have both potential benefits and drawbacks. The US government will need to carefully consider all of its options and choose the one that is least damaging to the economy.

Here are some additional thoughts on your suggestions:

- Transitioning to a new currency. This would be a major undertaking, and it would be important to have a well-thought-out plan in place. One of the biggest challenges would be gaining public acceptance of the new currency.

- Using different currencies for cash and savings. This is a more feasible option, but it would still be important to choose the right currencies for each purpose. It would also be important to educate the public about the risks and benefits of using different currencies.

Ultimately, the best way to protect yourself from the risks of high US debt levels is to diversify your savings and investments. This means investing in a variety of asset classes and currencies. It is also important to have a financial plan in place so that you can weather any economic storms.

Can you provide any other options that I haven’t thought of? #

Sure, here are some other options for dealing with high US debt levels:

- Increase economic growth. This would increase the size of the US economy and make it easier to service the debt. However, it is important to note that economic growth is not always guaranteed, and it can be difficult to achieve.

- Improve tax collection. This would increase the amount of revenue available to the government to service the debt. However, it is important to note that tax increases can be unpopular with the public.

- Sell government assets. This would raise money that could be used to pay down the debt. However, it is important to note that selling government assets can reduce the government’s ability to provide services.

- Restructure the debt. This could involve changing the terms of the debt, such as the interest rate or the repayment schedule. This could make the debt more manageable for the government. However, it is important to note that restructuring the debt can be difficult to negotiate with creditors.

It is important to note that all of these options have both potential benefits and drawbacks. The US government will need to carefully consider all of its options and choose the one that is least damaging to the economy.

In addition to the above options, there are some more radical options that have been proposed, such as:

- Abolishing the Federal Reserve. This would give the US government more control over the money supply and make it easier to service the debt. However, it is important to note that abolishing the Federal Reserve would have a significant impact on the US economy and the global economy.

- Adopting a cryptocurrency as the national currency. This would reduce the US government’s reliance on the traditional banking system and make it easier to service the debt. However, it is important to note that cryptocurrencies are still relatively new and volatile.

It is important to note that these radical options are very controversial and there is no consensus on their feasibility or desirability. The US government would need to carefully consider the pros and cons of any radical option before making a decision.

Ultimately, the best way to deal with high US debt levels is to make a combination of changes, such as reducing spending, increasing taxes, and increasing economic growth. The US government will need to work with the private sector and the public to develop a plan that is sustainable and equitable.

Of the following 6 options, please estimate the likelihood as a percentage. #

Here are the options:

1) Debt Jubilee, or forgiveness

2) Adopt a hard money like gold, sliver, Bitcoin

3) Adopt Modern Monetary Theory

4) Soft Default through gradual higher inflation

5) Hard Default: quick devaluation

6) Transition to a new system, be that gold, Bancor, Bitcoin, or something else

Here is my estimation of the likelihood of the 6 options you listed, as a percentage:

| Option | Likelihood (%) |

|---|---|

| 1) Debt Jubilee | 10% |

| 2) Adopt a hard money | 5% |

| 3) Adopt Modern Monetary Theory | 20% |

| 4) Soft Default | 40% |

| 5) Hard Default | 15% |

| 6) Transition to a new system | 10% |

It is important to note that these are just my estimates, and the actual likelihood of each option will depend on a number of factors, including

- the political climate,

- the state of the economy, and

- the reaction of global markets.

I would also like to add that some of these options are more likely than others to be effective in reducing US debt levels. For example, a debt jubilee or a transition to a new system would be effective in reducing debt levels. However, these options are also the most difficult to implement, as they would require a significant change to the current economic system.

Other options, such as a soft default or a hard default, may be more feasible to implement. However, these options would also be more disruptive to the economy and could lead to negative consequences such as inflation and economic instability.

Ultimately, the best way to deal with high US debt levels is to make a combination of changes, such as reducing spending, increasing taxes, and increasing economic growth. The US government will need to work with the private sector and the public to develop a plan that is sustainable and equitable.

It is also important to note that the likelihood of any of these options occurring is difficult to predict. The US economy is a complex system, and there are many factors that could influence its future direction.

My Base Case. #

My base case is all options except #5 will occur, at least in part:

Here is my synthesis of how these options could be combined:

David Graeber, author of Debt: The First 5,000 Years, wrote a historical framework for a (#1) debt jubilee. I expect student debt, public pension bailouts, etc will be tried, likely in an ad hoc way. But what I would emphasize is that regardless of a formal debt jubilee, the equivalent will take place through — (#4) a soft default which functions as an effective debt write-down through debasement of currency (causing inflation).6 This could be initiated by full or partial adoption of (#3) Modern Monetary theory, which holds that it is more tenable than commonly thought to run significant deficits. MMT says that the only limit on spending should be inflation, not deficits. The problem with this is that politicians will not implement MMT responsibly and inflation works on a lag.

Suppose there is a financial crash tomorrow that results in the Fed cutting interest rates to zero. Such a rate cut would enable much more debt to be issued, but the country’s true financial status will be masked until the bonds mature and payment must be made. Once the money has been borrowed, the financial squeeze will be “baked in,” even if inflation has not yet risen. On the Grant Williams podcast, David Hay predicts that Jay Powell will resign and a more compliant successor will implement QE. 7 (#4: Soft Default) can coincide with a ..

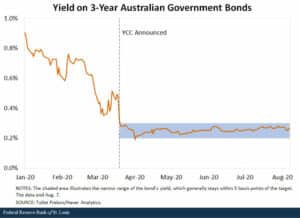

(#6) partial transition to a new system, because investors will look for alternatives to bonds. It is expected that the US government will implement yield curve control 8 to prevent interest rates from from rising beyond the government’s ability to pay.9 This would cause bonds to have interest rates less than inflation, allowing the government to inflate away the debt. 1011 People will still hold bonds, but on the margin, gold, bitcoin, real estate, and other (#2) hard assets will see increased demand, as stores of value which can not be so easily debased.

In the present global economy, the dollar is used as the medium of exchange 12 and the treasury bond used as the store of value (because it yields interest).

My base case is that the dollar will remain the medium of exchange, at least in the mid-term, but the Treasury bond will lose market share as a store of value, at least until debt levels are reset to more manageable levels and bonds return a positive real rate of interest. 13

Alternate Stores of Value: Gold/Real Estate/Bitcoin/Commodities

There is a debate whether the BRICS 14 is devoid of substance or whether it will herald major economic changes. I’ve heard Jim Rickards say that the BRICS system is actually ingenious, (24:01 – 26:03) but misunderstood. He says the system is not based on “backing” a currency with gold, but by using the gold price as a reference (or unit of account 15). 16

Jim Rickards sees BRICS not having an immediate effect, but the dollar will gradually lose value to gold over time (23:25) and the demand for US Treasuries will decrease.

On the other hand, Micheal Howell predicts that commercial banks’ balance sheet will merge with central banks and hold more government debt.

BRICS

We can now see the first BRICS countries conduct trade in their native currencies and save the proceeds in gold. Who knows how significant this will be in the future?

Example from Grant Williams podcast:

- China buys Brazilian resources, like soybeans, with yuan. 17

- Brazil uses some of the yuan to buy Chinese goods.

- Brazil saves the remaining yuan by converting it to gold on the Shanghai gold exchange, instead of saving it in Treasury bills.

There is also the potential of Bitcoin to be used as an alternative store of value, but the dollar would continue to be used as the medium of exchange as long as Bitcoin remains too volatile. 18

CDBC

If the dollar is digitized as a CDBC 19 which people everywhere (Latin America, Africa, Asia, etc) can hold on their mobile phones, I would expect the dollar to displace more countries’ weak currencies because it will be the strongest of fiat currencies. (Sort of like the world’s “tallest dwarf” meme, or “tallest little person”)

Hard Assets

Despite the global popularity of the dollar as a currency, I expect the system to become more strained and the value of hard assets to rise. Whereas governments have been entrusted with the ability to issue fiat currency without backing, I would hypothesize partial backing be valued as a way to create guardrails in treacherous economic conditions. 20 If Bitcoin were to become more popular, it, along with gold, could be used as a backing for currencies that desperately need to reassure their holders.21 I do not see Bitcoin emerging as a medium of exchange in the US until volatility is reduced 22 but increased usage as a store of value would increase the likelihood that Bitcoin’s market cap grows and volatility decreases.

Volatile Inflation #

Hyperinflation is sometimes defined as accelerating inflation measuring 50% or more per month. I don’t expect hyperinflation.

But even if I’m right about moderate inflation lasting over a decade (@ 0-25% / year), I expect the inflation rate to be volatile.

It doesn’t make sense to speculate on moderate inflation because the market can defy expectations.

Even with the benefit of hindsight, knowing that in Weimar Germany gold preserved value better than the German mark, those Germans who would have borrowed marks to buy gold would have been wiped out by the volatilaty, because the gold price was so volatile:

You’ll often see charts from Weimar Germany of gold priced in the paper mark going parabolic.

What that chart doesn’t show is the sharp drawdowns & volatility that occurred during the hyper-inflationary period. Speculating using leverage got wiped out multiple times.$BTC 1/2 pic.twitter.com/tZhpP1KMS1

— Dylan LeClair (@DylanLeClair_) May 23, 2021

Links

- Google Bard’s AI: ask your own questions

- What Is Yield Curve Control? (St. Louis Federal Reserve)

- The plan was to inflate the debt away, but Powell raised interest rates and now treasuries are in trouble if oil and the dollar don’t go down, Luke Gromen, (Blockworks)

- Post WWII: They liquidated the debt: they “snookered” people

- Larry Summers & Jason Furman wrote a paper in 2020: we need to inflate the debt away using the post-WWII playbook to bring debt/GDP between 70-80% in 3-5 years.

- They didn’t let inflation run hot in 2022 & 2023. Debt to GDP didn’t come down because they weren’t aggressive enough because of Covid & Ukraine and they changed their mind.

- Powell broke the energy market: If interest rates increase US shale oil production will fall and oil prices will increase, as US loses pricing power to Saudi Arabia & Russia

- This is going to lead to ~5 years of negative real rates and the fed buying the bond market with capital controls

- The US owes social security benefits in a currency it can’t print: it’s Argentina with American characteristics

- Peak Cheap Oil will break the Petrodollar because oil producers don’t want to hold Treasuries that are debasing, Luke Gromen

- Jay Powell will resign and his successor will restart Quantitative Easing, David Hay (Grant Williams podcast, transcript)

- BRICS plan to be based on Keynes’ Bancorp idea. James Rickards (Wealthion)

- How Brazil and China transact in Yuan and save in Gold, Adam Rozencwajg (Grant Williams podcast, transcript)

- Debt: The First 5,000 Years, David Graeber (Google Talk)

- Commercial banks’ balance sheets will merge with central banks and hold more government debt, Micheal Howell (Blockworks)

Footnotes:

I’m assuming both government, business, and private debt must be reduced through some means because at some point the interest on the debt will become generate unacceptable levels of inflation.↩

(Google Bard is an AI, like Chat GPT)↩

And likely also high debt levels in other parts of the world. ↩

The AI seems to be assuming that the government assumes the debt of other entities such as states or pension funds. This may occur, but many people may expect the debts to be written off entirely, not assumed.↩

But there might be less of a stigma if most other governments also forgive debt.↩

This runs contrary to Dr. Lacy Hunt: “Once you allow the inflation to get out of control then basically you’re setting up the the situation that will lead to instability on the downside okay and I’m guessing you would say nine percent CPI as we saw last year that’s serious inflation you you cannot let inflation run hot .. It hurts too many people and causes too many imbalances.” (44:56) ↩

You may be skeptical of this, thinking Hay is talking his book, as he is invested in Gold miners. The question is whether his conviction led him to choose gold miners or whether his position prompts him to hallucinate about Jay Power and QE.↩

] Yield curve control: can be thought of as a more effective form of QE: In QE the central bank buys bonds, but does not have a target for what interest rate those purchases will bring. In YCC, the central bank intentionally buys enough bonds to reach a certain interest rate target ↩

Brookings (not Brookings Institute): This raises one attractive feature of the strategy: if investors believe the Fed will stick to the peg, the Fed could achieve lower interest rates without significantly expanding its balance sheet. In theory, if the commitment to the peg were fully credible, the Fed may not have to purchase any bonds at all.↩

If you read the St Louis Federal Reserve site from 2020, you can see 3 times when governments have used this approach: post WWII, 2016 Japan, and 2020 Australia. Why wouldn’t the Fed apply this technique to reduce present levels of debt as a percent of GDP, allowing inflation to run higher while bondholder interest is suppressed?↩

As an example, bonds may return 4%, but inflation will run at a higher level: lets say an average of 8%. Over a decade, this will result in a drop in of debt as a percentage of GDP.

This sort of inflating away the debt occurred in the decade after World War II.↩

A medium of exchange is an intermediary instrument or system used to facilitate the purchase and sale of goods and services between parties.

For a system to function as a medium of exchange, it must represent a standard of value. Further, all parties to the transaction must accept that standard.

In modern economies, the medium of exchange is currency. – Investopedia ↩

Who wants to hold a 4% treasury bill when interest rates are ranging between, say, 3% and 12%? Perhaps the banks will be co-opted to do so. (see more below)↩

Brazil, Russia, India, China, and Saudi Arabia are forming a block of countries that may function as an alternative economic system to “western”-dominated organizations like the G7.↩

Unit Account: a measure of which prices are set in. If an American buys something from Europe, the price may be set in Euros. An equivalent amount of dollars will then be converted into Euros and sent to the European vendor.↩

I think BRICS may also involve using gold as an alternative store of value, but I haven’t confirmed this.↩

China makes a distinction between yuan — is currency, and renminbi — its unit of account. I may not be using the correct terminology here.↩

Bitcoin must also have a high enough market cap to enable enough liquidity.↩

Central Bank Digital Currencies are an entirely digital currency that is run by central banks directly, without requiring private banks.↩

Weaker fiat currencies would find themselves under greater pressure to back themselves with hard assets (commodities of various types) or dollarize. ↩

I would expect that countries would use a basket of a variety of commodities. Gold would be preferred by the older generation. Bitcoin’s superior audit-ability makes it attractive once its properties are understood.↩

or inflation becomes sufficiently punishing↩