This is an episode of Off The Chain with host Anthony “Pomp” Pompliano and guest, Raoul Pal, the CEO of Real Vision Group.

Understanding The Fed – Is the Repo Market Broken? (w/ Raoul Pal)

Real Vision CEO, Raoul Pal, examines via Skype the recent turmoil with an international cadre of outspoken experts: monetary economist George Selgin, George Goncalves of The Bond Strategist, Scott Skyrm, executive vice president at Curvature Securities, and Dr. Z. Barton Wang of Barton Research. Join Raoul on this voyage of discovery as he discusses repo and more with some of the sharpest minds in finance. Filmed on January 31, 2020, in Grand Cayman.

Notes:

< 8 min: I tend to agree with the Fed that the current repo operation is not QE, but that having a standing repo facility handles high demand (like at the end of the month)

There are multiple factors that combine to increase liquidity demand.

12 min: The balance sheet is never going to go down.

13:30 min: The Fed and Treasury don’t appear to be talking. One theory is that Mnuchin is trying to force the Fed’s hand

17:26 If we have a recession, we will see genuine QE that no one can deny.

I worry that they will resort to QE even if there isn’t a recession.

- corridor vs floor system

~19:30 There is a lot of leverage that keeps asset prices high and liquidity is necessary to support this.

I’ll all for the Fed providing liquidity, but there should be a penalty rate

20:10: I agree that QE will happen and it will arrive quickly.

The next QE will be done in such a technical way as to “bore” the public.

33 min: The Equity Markets believe they are doing a version of QE.

(QE) is like a calibration thing.

They are going to have to steepen the curve.

44 min: Most of the Hedge Funds that want cash want it first thing in the morning, but other players come in later (New York time)

48 min: Is excess leverage behind this?

55:50: So what you’re saying is that they can’t run such a large deficit. In a recession they could run a larger deficit.

1hr 01 min: To me, it smacks of leverage (from hedge funds)

1 hr 04 min: Why is the (Fed) balance sheet affecting equities?

According to Basel 3, Banks need assets at the Fed to participate in Repo market

- A lot of banks weren’t able to participate in the repo market,

- This affected the hedge fund’s ability to use leverage from borrowed repo money

- The repo market is the liquidity factor for leverage

- Higher repo interests spikes (2% -> 10%) caused the hedge funds to liquidate their positions

- The equity rallies are a direct consequence of the Fed Repo Liquidity

- Hedge funds are using the liquidity

The Fed is now going to be permanently involved. They messed up and now are going to oversupply, which they don’t view as a big problem.

1 hr 10 min: Treasury Securary Mnuch announced ..

They have tons of ammo to dump money into the economy right before the election.

Bond yields are collapsing.

If the US Dollar Collapses, European and Japanese will not be able to play in Equities so much and Equities could fall.

- Euro Dollar funding depends on Basel 3 regulations

1 hr 14 min: A steeper yield curve helps foreign buyers of Treasuries

- This means that they will likely have to cut rates (given corona virus and deficits)

- They will probably be forced to cut rates soon.

Bonds give better signals about the economic cycle than Stocks.

1 hr 18 min: It all depends on Treasuries (for equity) they have so much cash they can flood the market with $40 billion any time they want. Their action is the biggest contributor to volatility.

Is Mnuchin essentially using this as an economic weapon in his ability to micromanage the economy? (before the election)

I don’t know but he has a lot of ammo. It looks suspicious. We should ask him in his press conferences.

If he decides he wants to put money in his checking, there’s nothing the Fed can do about it without blowing up the markets.

This is unprecedented except during the financial crisis.

Treasure has become the marginal provider of liquidly and that who we should watch.

The Treasury General Account is the “nuclear weapon”.

There is a potential dollar collapse in the future. Markets can’t get enough dollars.

Raoul Pal’s Thesis: The “Doom Loop”

Raoul Pal is a former hedge fund manager who retired at age 36 but remains actively involved in the world of macroeconomics and finance. In recent years, he started a finance news and content service called Real Vision.

In a video posted on YouTube on August 14th, Pal discusses his case for a recession in the next year or so as well as a very alarming scenario he calls the “doom loop.” It’s a fascinating and frightening thesis, and I find it persuasive. Here’s the line of reasoning:

(1) The Fed lowers interest rates to stimulate the economy through increased lending. How else are lower interest rates supposed to stimulate anything besides through more lending, i.e. more debt?

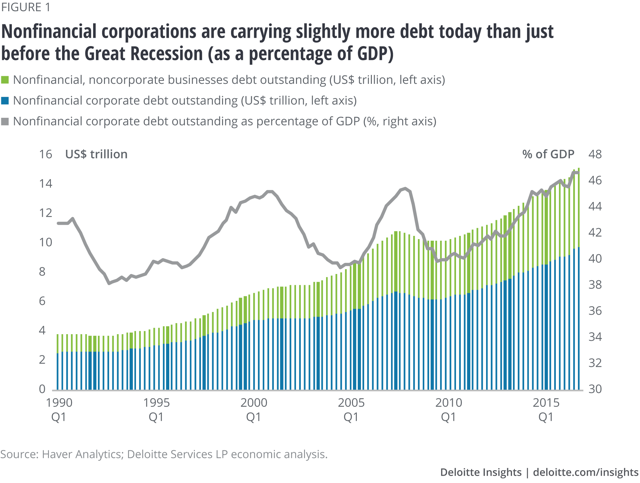

(2) As a result, all sorts of market and government actors increase their debt loads. Corporations, especially, took advantage of falling rates to refinance and take on more debt.

Source: Deloitte

(3) Some of this debt buildup has been for acquisitions or mega-mergers, but much of it was taken on simply for share buybacks. See, for instance, this chart showing the way in which debt issuance and share buybacks became tightly correlated right around the time that the Fed Funds rate bottomed near zero. (See my article addressing this subject here.)

Source: Hussman Funds

Debt-funded buybacks have served as a convenient way for corporate executives to lift earnings per share, thus meeting guidance more regularly and reaching the targets for their performance bonuses more often. (I wrote about this subject here.) What’s more, an SEC study found that insider selling tended to coincide with the announcements or implementation of buybacks.

(4) Indeed, if you look at the performance of U.S. stocks versus any other country or world region’s stocks, you’ll notice a stark difference. U.S. stocks have soared ahead of the competition. It turns out that this is largely because of buybacks, as corporations themselves have been the biggest net buyers of corporate stock since the Great Recession:

Source: Avondale Partners

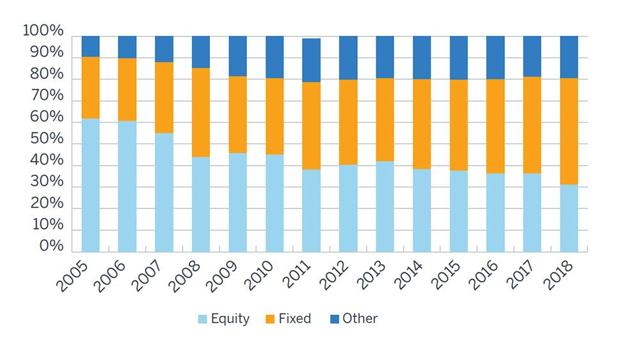

Notice that institutions (including pension funds) have been net sellers of U.S. equities since the recession. This likely means that pensions have been forced to sell many of their assets to fund benefit payouts but have sold other assets such as Treasuries at a faster rate than equities.

(5) Who is buying all this debt being issued to fund buybacks? The answer, in large part, is pensions. Mainly corporate pensions:

Writes Mark Johnson: “This uptick in bond buying has caused corporate pension funds to play a more influential role in the bond market, since pension managers tend to hold bonds for the long term. As more and more companies adopt the strategy of buying more bonds, pension demand could total $150 billion a year. It is estimated that corporate pension funds buy more than 50 percent of new long-term bonds, up from an estimated 25 percent a few years ago.”

So corporate pensions are buying more and more bonds. Which bonds? Specifically, corporate bonds: “Pension plans… like to use corporate bonds to hedge liabilities.” Corporate bonds offer the highest yields. Of course, pensions are only allowed to own investment grade corporate debt, but if they opt for longer duration or lower rated bonds they can get a higher yield. In the previous twelve months, BBB-rated corporate bonds have yielded as high as 4.83%, certainly better than the highest yield offered by the 20-year Treasury bill in the last twelve months — 3.27%.

BBB-rated corporate debt has grown to be roughly half of all corporate debt outstanding. That’s one (small, for some companies) step above junk status.

(6) During a recession, much of this investment grade debt (Pal guesstimates 10-20%) will be downgraded. But remember: pensions cannot own junk bonds. If BBB-rated debt on their books gets downgraded, they will be forced to sell it, even at a loss. If multiple downgrades happen quickly in succession, the supply of newly labeled junk bonds will overwhelm demand from other market buyers of those debt instruments. This could lead to a fire sale scenario, in which the prices of junk bonds plunge as pensions dump huge supplies into an unsuspecting market.

(7) Not only would pensions have to accept a fraction of their cost basis for these former investment grade bonds, they would also see their primary revenue stream — tax revenue — slacken during a recession. Tax receipts, after all, are as cyclical as the business cycle. When individuals and businesses aren’t making as much money, there is less available to be taxed. This would diminish demand for corporate bonds, which would cause corporate bond yields to spike.

(8) All of this chaos in the credit markets will make it very difficult for corporations to issue debt at anything other than high rates. This will cause the costs of new debt to soar high enough for buybacks to become prohibitively expensive. Moreover, cash flows will dry up, as they do in every recession, and thus every potential source of funds to use for buybacks will disappear.

Therefore…

(9) If the previous points play out, the biggest net buyer of U.S. equities over the last ten years will no longer be a buyer. “The largest buyer will have left the room,” as Pal says. In fact, publicly traded corporations may actually be net issuers of shares during the next recession as they were in 2008-2009.

In the words of Jesse Colombo, “If the stock market performed as poorly as it did in 2018 with record amounts of buybacks to prop it up, just imagine how much worse it would be if buybacks were to slow down significantly or grind to a halt?”

I don’t see how the preceding chain of events playing out as described would not ultimately result in a very nasty stock market crash. Whether it’s a relatively quick crash like in 2008-2009 or a bit more drawn out like from 2001-2003 is unknown. Either way, I see the above scenario as plausible. Disturbingly so.

Since I’m an income-oriented investor, my preferred method of hedging against this possible crash scenario is to hold ample cash and ultra-short term bond funds. That way, if this scenario does play out, I will be prepared to buy assets at fire sale prices with yields higher than I might ever see again in my lifetime.

Raoul Pal’s thesis is fascinating, but it could be wrong. What I’m much more certain of is that the Fed bears the majority of the blame for the underfunding of pensions and thus for putting us into a situation in which Pal’s thesis would even be possible.

Here’s How One Former Hedge Fund Manager Plans To Democratize Financial Information

Raoul Pal’s best idea came to him over a glass of wine with Grant Williams.

It was Spain, the year was 2013, and Pal was producing his own research publication called The Global Macro Investor. Years earlier, he’d left a global macro hedge fund called GLG Partners when the industry veered in a direction he didn’t like.

Coming into his conversation with Williams, Pal had already spoken with two friends about the changes sweeping the media landscape and the inability of television companies and publishers to adapt. As the two enjoyed their wine, Pal threw out a crazy idea: why not start their own on-demand TV channel for finance?

A year later, the duo worked with three other founders to bring that idea to life. The end result was Real Vision, which was born with a simple mission: democratizing financial information in as many ways as possible for as many people as possible.

The company produces free content, including a podcast called Adventures in Finance and its 20/20 newsletter, and paid content that includes two newsletters – Real Vision Think Tank and Macro Insiders – and high-quality videos available by subscription. Providing actionable data to paying subscribers was a risky choice in a world where free, bite-sized content with punchy headlines seems to be the preference.

“When we started this business, we could have gone the route of BuzzFeed or Business Insider and generated content, gone after advertising dollars, and chased the short attention span with the clickbait headlines,” Pal said. “When we sought advice, we were told people would not be willing to pay to watch longform videos. Being contrarians, we decided to offer hour-long conversations on a subscription basis.”

The reasoning for why Pal and his fellow co-founders decided to go against industry trends offers a compelling lesson for aspiring entrepreneurs: “The opportunities always lie where everybody else is not doing something.”

Video creators are attractive in the new media landscape

Right now, the hottest opportunity with content is video. This is true online and with television, where cable is being disbanded and companies like Amazon, Netflix, Apple, HBO and Disney are rushing to be both providers and content creators. Real Vision has become a highly attractive proposition by creating relevant and insightful video content, especially with a younger generation of investors and curious financial minds.

“The average viewer of CNBC is 63 years old,” Pal explained. “Meanwhile, we have deals with Cambridge University and MIT to attract students. We have Millennials, Gen X’ers and Baby Boomers. Our audience skew is young, massively educated, and well-paid, which is a fantastic demographic to have in this platform world.”

Pal’s opinions on what financial media should be were formed in part from watching the mainstream media cover the financial crisis of 2008. Pal was appalled by the way print publications and news networks opted for racy, exciting coverage that treated the loss of people’s life savings with such flippancy. He also saw a lack of truth and balance in the narratives that were being presented to everyday investors.

“The narratives given to the world are often picked by investment banks because they don’t want to take you the darker side of what’s going on in the world,” Pal said. “There are sites like Zero Hedge where people can see what’s really going on, but I saw a need for more truth and balance in finance. That’s how our ideas came together.”

Navigating the challenges of entrepreneurship

Seizing opportunity always comes with risk, as Pal and his team discovered while they worked to start the company, which was financed for the first couple years. A large chunk of those funds was spent on a platform that could handle the demands Real Vision’s video library would place on the site, especially as its user base expanded. When the site went live, the team was horrified to learn that users were universally having trouble playing videos in their browser. Thankfully, a Swedish developer based in Malaysia reached out and helped Real Vision build their current platform.

But that initial mistake torched over a million dollars of funding. Pal learned an important startup lesson in those early days that every founder should know going in:

“You really don’t know what you’re doing most of the time.”

To paraphrase Reid Hoffman, Pal discovered that running a startup is like “throwing yourself off a cliff and trying to assemble a parachute on the way down.” It’s been the biggest challenge of his career partly because of how little he knew about his new industry, which required him to quickly accumulate industry knowledge. He also felt out of his element managing video editors, so he had to acquire new management skills.

When your company grows seven-fold in 18 months, decision making happens rapidly and it can become difficult to maintain control. In order to manage Real Vision’s growth, Pal had to prioritize processes and structure, two concepts he’d paid little attention to up to that point in his career: “Get the process and the structure right,” he advised. “Without those things, you cannot build a business. It will keep falling over.”

Another hard reality that Pal had to confront was constant failure. As he learned from other founders, dealing with failure in a startup is all part of the process.

“We fail endlessly every single day,” Pal admitted. “But the point is that every time you fail, you pick yourself up, figure out why you failed, and then jump over that hurdle and keep going. You have to see hurdles as speed bumps and not brick walls. Just keep your eyes on the horizon and move forward without leaving a trail of destruction behind you. To do that, you need the right staff and the right infrastructure. It’s been hard, but starting this company is one of the most rewarding things I’ve ever done.”